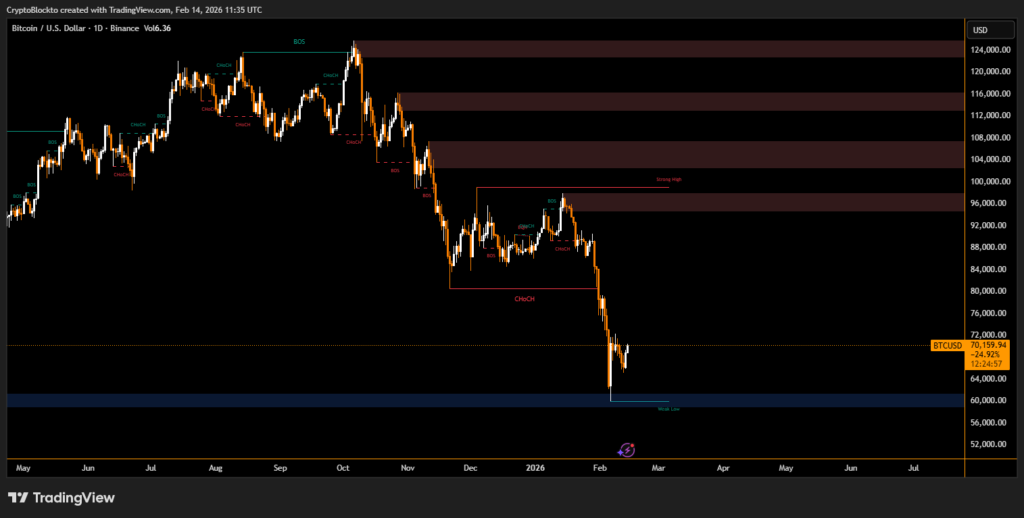

Bitcoin’s so-called “ultimate” bear market bottom may form around $55,000, according to analysis from CryptoQuant. The firm argues that major cycle lows typically take months to develop rather than emerging from a single capitulation event.

The key reference point is Bitcoin’s realized price — a metric reflecting the average cost basis of all coins in circulation. Historically, this level has acted as strong support during bear markets. Bitcoin is currently trading more than 25% above that threshold. In previous downturns, prices fell 24% below realized price after the FTX collapse and about 30% below it during the 2018 cycle before stabilizing.

Onchain Metrics Show No Full Capitulation Yet

Recent volatility triggered $5.4 billion in daily realized losses when Bitcoin dropped 14% to $62,000 on Feb. 5 — the largest daily loss since March 2023. Despite the scale, CryptoQuant notes that monthly cumulative realized losses remain well below levels seen at prior cycle bottoms.

Valuation indicators also remain above historical capitulation zones. The MVRV ratio has not entered extreme undervaluation territory, and Net Unrealized Profit and Loss has yet to reach the deep negative levels associated with past lows.

Long-term holders are largely selling near breakeven, rather than absorbing the 30%–40% losses typical at structural bottoms. Meanwhile, about 55% of Bitcoin’s supply remains in profit — higher than the 45%–50% range often seen at cycle troughs.At the time of writting btc recalims 70k level.

Separately, analysts at Standard Chartered recently projected that Bitcoin could briefly test $50,000 before recovering later in the year.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.