Bitcoin’s reputation as “digital gold” is being challenged as new research shows its price movements increasingly align with risk-on assets rather than traditional safe havens. Recent analysis indicates that Bitcoin’s short-term behavior has diverged from gold and silver, even as precious metals reached record highs.

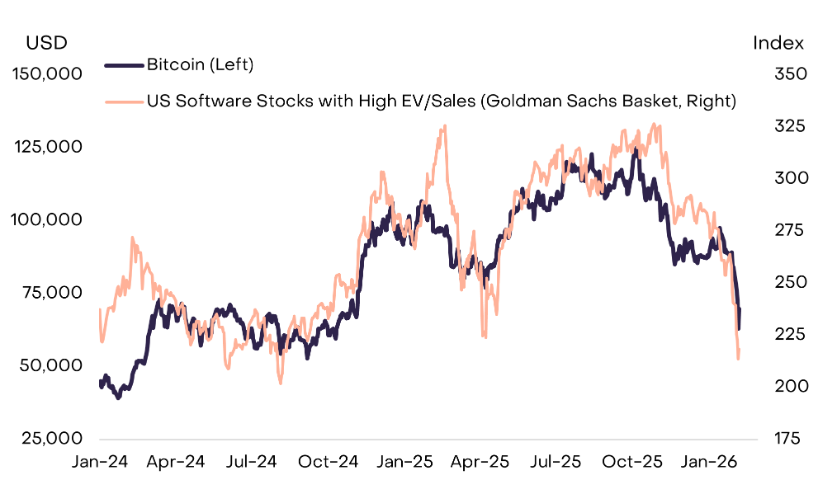

Instead of tracking defensive assets, Bitcoin has developed a strong correlation with equities, particularly software stocks, a trend that has intensified since early 2024. This shift suggests Bitcoin is currently trading more like a high-growth technology asset than a hedge against macroeconomic stress.

Software Stocks and Market Sell-Offs Influence Bitcoin

The data shows Bitcoin’s recent declines closely mirror sell-offs in the software sector, which has faced pressure amid concerns over artificial intelligence disrupting existing business models. Bitcoin’s growing sensitivity to equity market sentiment reflects its deeper integration into traditional financial systems through institutional participation and exchange-traded products.

Drawdowns and Selling Pressure

Bitcoin has fallen roughly 50% from its October high above $126,000, with losses unfolding across multiple liquidation waves since late 2025. Persistent selling pressure from U.S.-based investors has also weighed on prices, as reflected in ongoing exchange discounts.

Despite near-term volatility, Bitcoin’s fixed supply and independence from central banks continue to support its long-term store-of-value narrative. While it has yet to achieve gold-like monetary status, its role may evolve as digital markets, tokenized assets, and automated financial systems become more widespread.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.