Price Reacts Strongly from Demand Zones, Signaling a Potential Shift in Short-Term Momentum

Bitcoin has moved decisively above the $93,000 level, marking a notable recovery after weeks of downward pressure. The latest price action shows buyers stepping in at a critical demand zone, creating a rebound that now challenges an important resistance band highlighted on the chart.

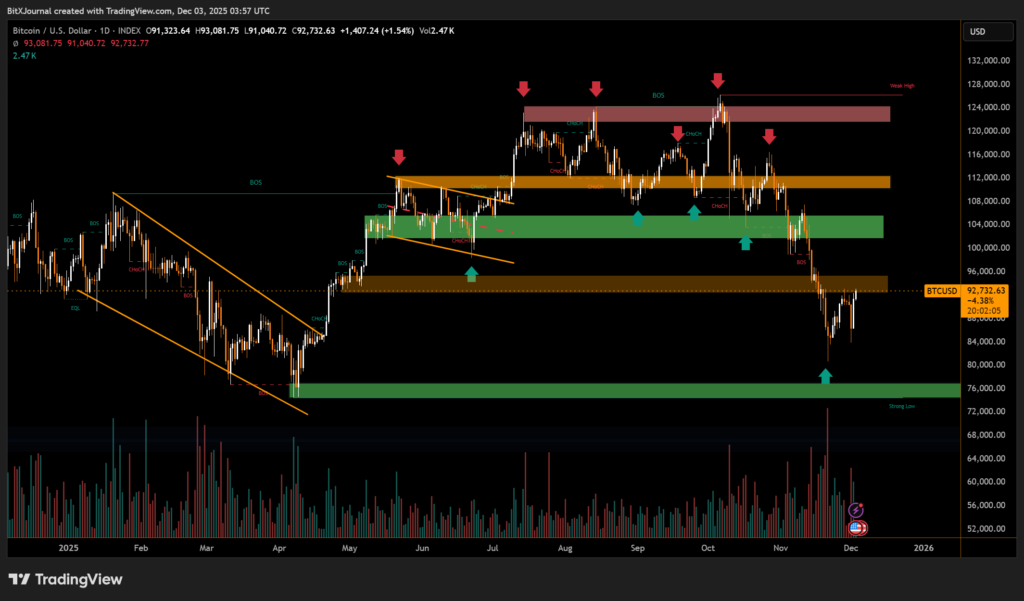

The structure visible in the recent data reflects multiple breaks of structure (BOS) and change-of-character signals, showing where momentum shifted throughout the past months. After a sharp decline into the broad support area around the mid-$80,000 range, BTC formed a reaction candle that suggested aggressive accumulation.

The current reclaim of $93,000 is significant because it represents the first strong attempt to stabilize above a level that previously acted as a breakdown point. The recovery also brings price back into a zone that was tested multiple times between August and October, where sellers consistently responded.

The markett highlights several supply and demand imbalances. The zone near $88,000–$90,000 provided the most recent reaction, while a deeper demand block around $74,000–$77,000 remains untested below. Until broken, these levels form the backbone of market structure.

Above current price, the next challenge lies in the $96,000–$100,000 region. A convincing move through this band would shift sentiment and potentially reopen the path toward the previous distribution zone between $118,000–$125,000.

Bitcoin’s recent push reflects a market attempting to regain control after prolonged weakness, setting the stage for a decisive end-of-year trend.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.