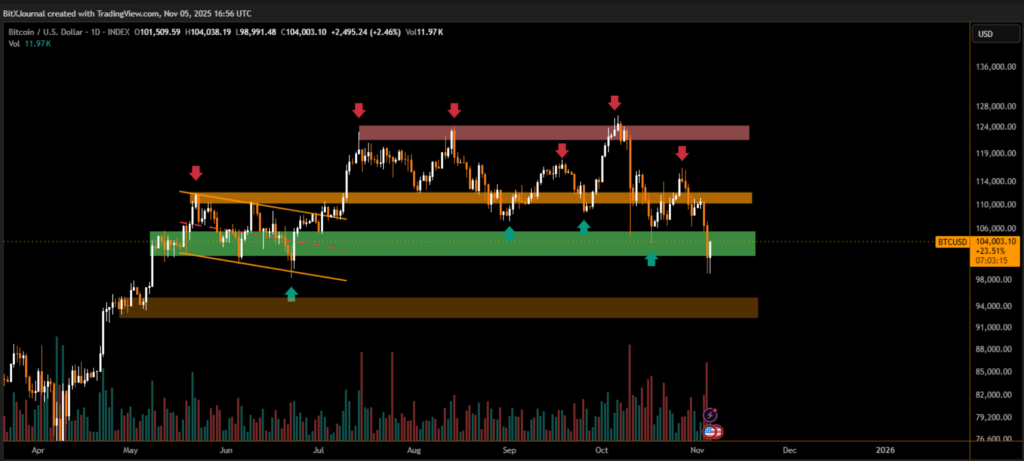

BTC Price Rebounds Sharply After Testing Lower Range Support

Bitcoin (BTC) has rebounded strongly, surging above the $104,000 mark after briefly dipping below the $100,000 level earlier this week. The move signals renewed buying pressure from market participants and highlights the resilience of Bitcoin’s mid-term bullish structure despite recent volatility.

Technical Recovery Above $104K Boosts Market Confidence

On the daily chart, BTC has reclaimed the green support zone between $102,000 and $105,000, a region that previously acted as a major accumulation range during the summer months. After testing this area multiple times, the cryptocurrency has once again demonstrated its strength, bouncing nearly 2.5% intraday.

“Bitcoin’s ability to hold above $100,000 and reclaim $104,000 suggests the correction may have reached exhaustion. A sustained close above $106,000 could reignite momentum toward $110,000–$114,000 resistance,” noted one BitXJournal technical analyst tracking large-volume flows.

The chart also shows consistent reaction points, with repeated rejections around the $120,000 zone (marked in red) serving as a ceiling for the current cycle. Below, the $98,000–$100,000 band remains a crucial line of defense for bulls.

Volume Confirms Reaccumulation

Trading volume increased notably as Bitcoin bounced from the green zone, reinforcing the idea that institutional buyers may be re-entering near structural support. Historically, these zones have preceded strong upward continuations when accompanied by higher on-chain activity and liquidity inflows.

The next key target for bulls lies near the $108,000–$112,000 region, where previous consolidations triggered profit-taking. If Bitcoin breaks this level, the broader structure could transition into a renewed uptrend continuation pattern heading into December.

Despite short-term uncertainty, Bitcoin’s rebound above $104,000 marks a significant psychological and technical milestone. As long as price action holds above the current support range, market sentiment is likely to improve, setting the stage for a potential retest of higher resistance zones before year-end.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.