Bitcoin could see renewed upside if capital begins rotating out of overheated artificial intelligence equities, according to macro strategist Lyn Alden. The argument centers on valuation pressure in major AI stocks, particularly as investors question how long rapid earnings growth can justify soaring market caps.

AI leaders such as Nvidia have delivered strong gains over the past year, fueled by demand for GPU infrastructure supporting machine learning systems. However, when stocks become priced for near-perfect execution, even solid quarterly results may struggle to sustain momentum. Historically, periods of extreme concentration in one market segment often precede capital rotation into alternative assets.

Capital Rotation and Bitcoin Demand Dynamics

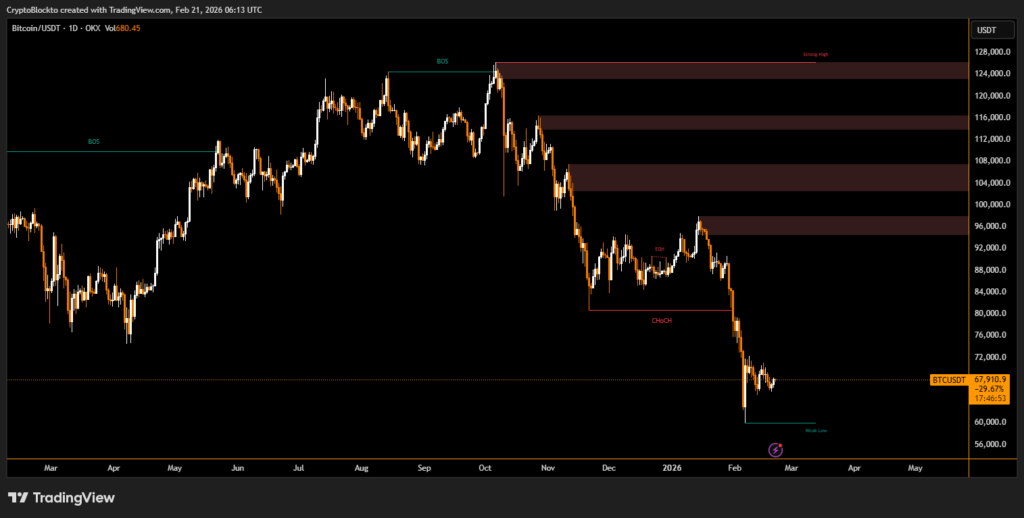

Bitcoin is currently trading near $67,800, significantly below its previous peak above $126,000. Despite the pullback, Alden suggests Bitcoin does not require massive inflows to move higher. With a substantial share of supply held by long-term investors, only a marginal increase in new demand can have an outsized impact on price.

She also cautions that sharp V shaped recoveries are rare outside extraordinary liquidity events. Instead, Bitcoin typically forms extended consolidation phases before resuming an upward trend.

If AI equities reach valuation ceilings and investors seek asymmetric opportunities, Bitcoin may benefit from even modest portfolio reallocations in the months ahead.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.