BCH retraces sharply after failing to hold the upper supply zone, signaling a renewed battle between bulls and sellers

Bitcoin Cash slid 6% in the past session, reversing earlier gains as price action reacted sharply to a major resistance band that has capped upside attempts since late summer. The sudden pullback comes at a crucial moment in BCH’s multi-month structure, with traders watching for signs of whether the asset can maintain its broader bullish recovery or slip into deeper correction territory.

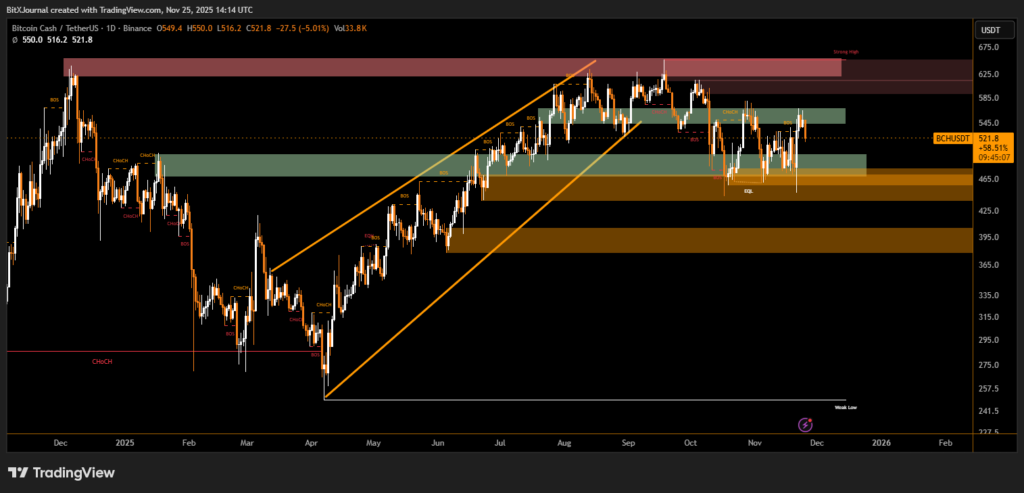

Sharp Reversal From Supply Zone

The decline followed an attempted breakout into a wide red supply region between $610 and $650, where BCH has consistently struggled to secure a daily close.

The latest rejection at this zone sparked a rapid sell-off, pushing the price back toward the mid-range support near $520.

BitXJournal Technical analysts highlighted the significance of repeated Breaks of Structure (BOS) around the upper boundary, calling the region “one of the strongest overhead walls BCH has faced all year.”

“The reaction shows sellers defending aggressively. BCH remains in a broader uptrend, but this rejection confirms that the market isn’t ready to support a clean breakout yet.”

Key Levels Now in Focus

The chart reveals several critical zones. The green demand region around $500–$470 remains the main short-term buffer. BCH tapped this area twice in recent weeks, each time producing a strong rebound.

A decisive close below $470, however, would shift momentum firmly bearish and expose deeper levels around $430 and $400.

Meanwhile, the upper supply region continues to define the broader ceiling.

According to BitXJournal another analysts,

“Unless BCH reclaims $585 with conviction, buyers will likely remain cautious. The structure still favors consolidation rather than an immediate rally.”

Despite today’s pullback, BCH remains above its critical mid-year trendline and has not yet broken its higher-low structure. Still, the 6% drop serves as a reminder that market sentiment remains fragile.

For now, Bitcoin Cash sits at a crossroads, with the next weekly close expected to determine whether the bulls regain control or if the market prepares for a deeper corrective phase.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.