Muted currency reaction contrasts with modest strength in digital assets following a widely anticipated policy move.

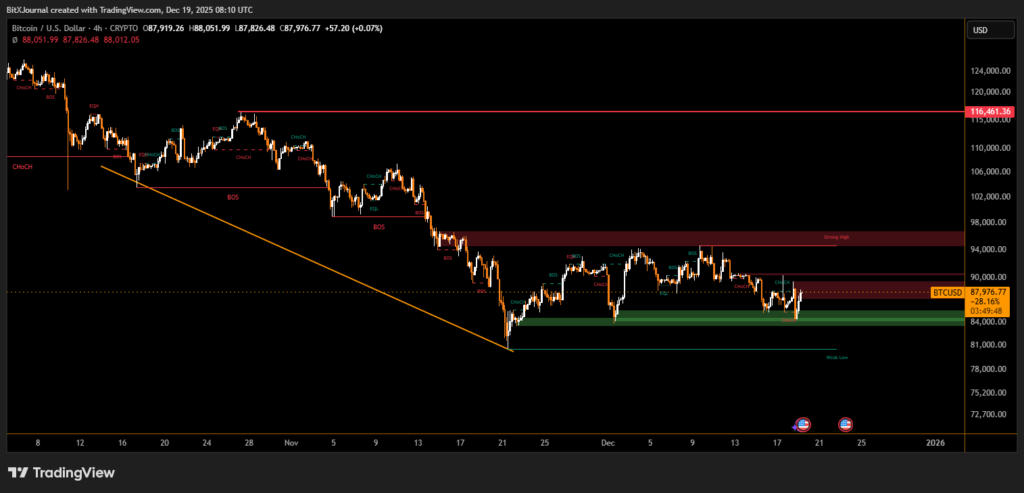

Bitcoin moved slightly higher, trading above the $87,000 level, after the Bank of Japan delivered a long-expected interest rate hike. The central bank raised its short-term policy rate by 25 basis points to 0.75%, marking its highest level in nearly three decades. Despite the historic shift, traditional markets showed limited reaction, while bitcoin edged higher amid steady demand.

Bank of Japan Rate Decision and Market Response

The rate increase was largely priced in by investors, reducing its immediate market impact. Currency traders had already positioned for tighter policy, leaving little room for surprise. As a result, the Japanese yen weakened against the U.S. dollar, underscoring how expectations, rather than the decision itself, drove price action.

Bitcoin’s move above $87,000 reflected resilience rather than a breakout. Price action remained range-bound, suggesting that traders are cautious amid broader macro uncertainty. Still, the ability to hold above recent support indicates underlying strength in spot demand, even as volumes stayed moderate.

Bitcoin showed relative stability compared to traditional currency markets.

The contrasting reactions highlight a growing divergence. While the yen struggled despite tighter monetary policy, bitcoin benefited from its role as a non-sovereign, supply-constrained asset. Investors continue to view it as insulated from country-specific policy shifts.

With the rate hike now behind markets, attention may shift toward global liquidity conditions and upcoming central bank guidance. For bitcoin, sustained movement above current levels would require stronger conviction, but the latest price action suggests buyers remain active on dips.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.