Bitcoin pushed higher over the past 24 hours even as broader sentiment indicators signaled “extreme fear” across the crypto market. The world’s largest cryptocurrency traded around $68,041, gaining 1.25%, while the broader digital asset index rose 1.18%. The rebound follows a sharp selloff last week that dragged bitcoin close to $60,000.

Bitcoin Price Recovery After Record Realized Losses

The recent decline triggered $3.2 billion in realized losses, marking the largest capitulation event in bitcoin’s history, surpassing the losses seen during the 2022 Terra collapse. On-chain data shows a rapid exit by low-conviction holders, while derivatives markets reflected a steep drop in open interest. The scale of liquidations suggested widespread panic before prices stabilized.

Despite that turbulence, selling pressure appears to be fading. Traders have shown resilience even as expectations for near-term Federal Reserve rate cuts continue to diminish.

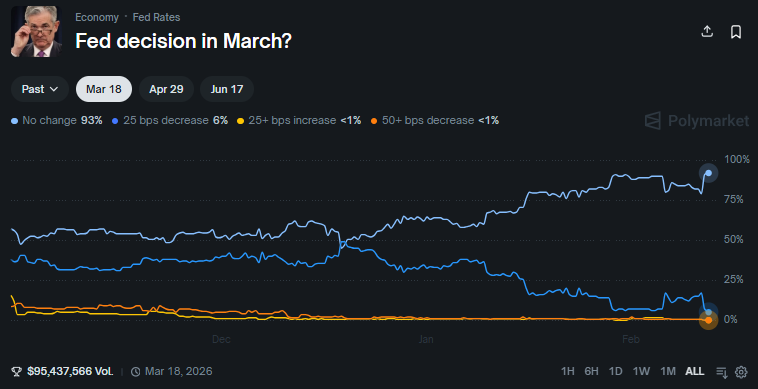

Federal Reserve Rate Cut Odds Fall Sharply

Prediction markets now show just a 7% probability of a 25-basis-point rate cut next month, down from nearly 20% previously. Higher-for-longer interest rate expectations typically weigh on risk assets, including cryptocurrencies, as fixed-income yields remain attractive.

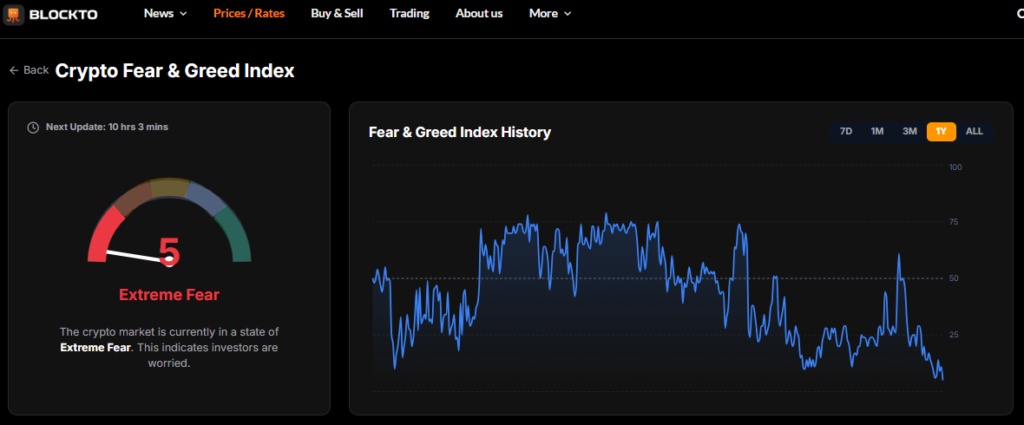

Crypto Fear and Greed Index Signals Extreme Fear

Market sentiment indicators have fallen to levels not seen since the collapse of a major exchange in 2022. Historically, such readings have coincided with potential market bottoms, as excessive pessimism often precedes stabilization.

Investors are closely watching the upcoming U.S. Consumer Price Index report, which may shape expectations for monetary policy. Inflation data will likely determine whether bitcoin’s recovery gathers momentum or faces renewed pressure in the days ahead.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.