Bitcoin may be poised for a breakout if global central banks respond to mounting stress in Japan’s bond market with renewed liquidity support. That is the view of Arthur Hayes, who argues that monetary intervention tied to Japan could become a catalyst for crypto markets.

Japan Bond Market Stress and Yen Weakness

Japan is facing a rare and concerning scenario where the yen is weakening while Japanese government bond (JGB) yields are rising. This combination suggests eroding confidence in the country’s debt market. Rising yields increase pressure on domestic investors and raise the risk that Japanese institutions could sell US Treasuries to shift capital back into higher-yielding JGBs.

Such a move could ripple into US markets and force policy intervention.

How the Fed Could Respond

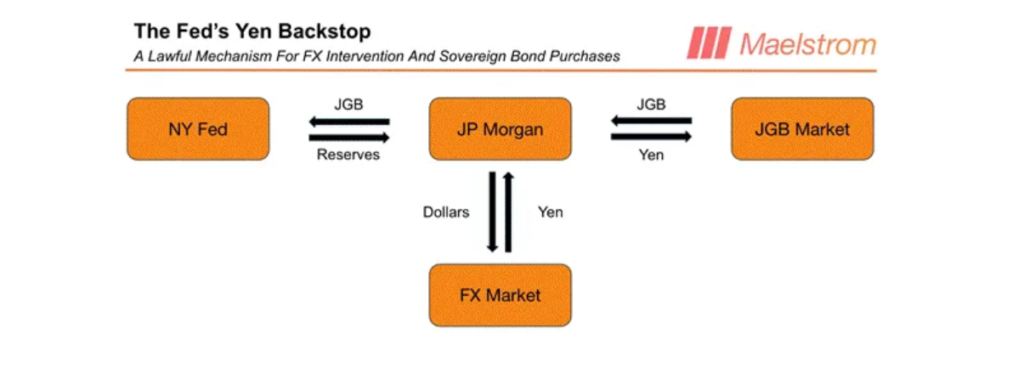

Hayes believes the Federal Reserve may step in indirectly to stabilize the situation. One potential mechanism involves the Fed expanding its balance sheet by creating dollar reserves, exchanging dollars for yen, and using those yen to purchase JGBs.

This process would effectively inject fresh liquidity into the global financial system.

According to Hayes, this type of monetary expansion has historically supported risk assets, including Bitcoin.

Hayes argues that Bitcoin has been stuck in a sideways trading phase due to tight liquidity conditions.

A return to money printing could provide the “liquidity shock” needed to restart upward momentum.

The US dollar index recently fell to multi-year lows, reinforcing the case for shifting currency dynamics. Hayes says confirmation will come from changes in the Fed’s balance sheet data, which he is closely monitoring for signs of intervention.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.