A growing wave of Bitcoin price crash forecasts may not be based on market fundamentals but rather on self-interest, according to leading Bitcoin analyst PlanC.

In a recent appearance on the Mr. M Podcast, PlanC argued that many traders who have recently sold their Bitcoin (BTC) are now using social media to influence market sentiment downward, hoping to profit from lower prices.

“If you sold, you really want lower prices,” he said. “The whole point of selling is that you expect a bear market — so you’re going to get on social media and push that narrative.”

Social Media Sentiment Still Positive Despite Fear Index Drop

The comments arrive as the Crypto Fear & Greed Index hit an “Extreme Fear” reading of 20, signaling that broader crypto sentiment has sharply declined. However, data from Santiment shows a different story for Bitcoin: 57.78% positive, 15.80% neutral, and 26.42% negative mentions across major platforms — indicating that overall market confidence remains resilient.

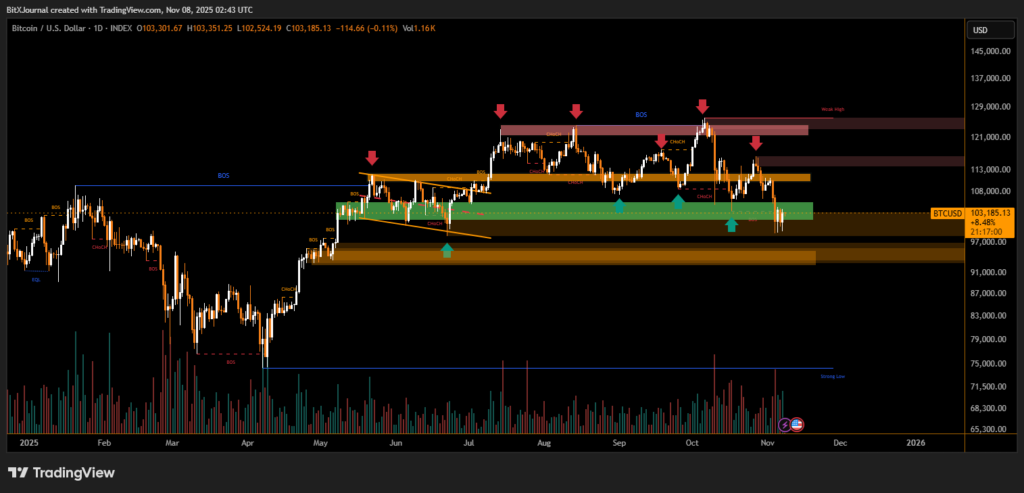

Bitcoin’s price recently dipped below the psychological $100,000 mark, reaching $98,000 before rebounding. At press time, BTC trades at $103,562, according to BITXJOURNAL, reflecting a 16.15% decline over the past month.

Analyst Suggests Bitcoin May Have Found Its Local Bottom

Despite the pullback, PlanC believes the market may have already reached a local bottom.

“I think there’s a decent chance that was the major bottom,” he said. “If it wasn’t, I don’t see us going down much lower.”

Still, the analyst warned of potential short-term volatility, suggesting Bitcoin could “go for one more scare” in the coming week, possibly testing $95,000 before resuming its upward trend.

Other Analysts Predict Deeper Corrections

Not all analysts share PlanC’s optimism. Bloomberg’s Mike McGlone recently wrote on X that Bitcoin reaching $100,000 might be a “speed bump toward $56,000.” Meanwhile, ARK Invest CEO Cathie Wood revised her long-term Bitcoin price target downward by $300,000, citing macroeconomic pressures and shifting capital inflows.

Market Outlook

While bearish sentiment dominates headlines, on-chain and sentiment data still point to a strong underlying confidence in Bitcoin’s long-term trajectory. As volatility continues, traders are advised to separate emotion-driven narratives from actual market structure and accumulation patterns.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.