BTC inflows rise amid altcoin weakness, signaling renewed market consolidation ahead of key resistance

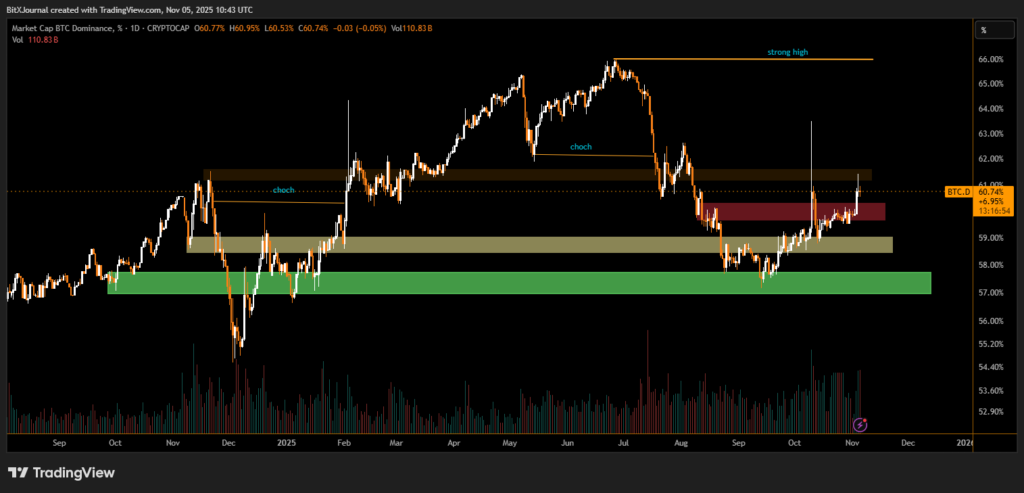

Bitcoin’s dominance over the cryptocurrency market surged to 60.75% this week, edging closer to the critical 61.50% resistance zone, as capital continues to rotate away from altcoins into Bitcoin. The move highlights a renewed risk-off sentiment among traders seeking stability in the market’s largest digital asset.

The dominance chart — a measure of Bitcoin’s share of total crypto market capitalization — shows a clear technical breakout from the 59% consolidation range, confirming a structure shift that began in mid-October. Analysts suggest that the strength reflects a combination of Bitcoin inflows and altcoin weakness, particularly across DeFi and Layer-1 ecosystems.

“The dominance chart shows a clean push through prior liquidity levels with volume confirmation. If BTC.D sustains above 61%, it could pressure major altcoins further in the short term,” said BitXJournal market analyst.

On-chain data supports this narrative, with several major exchanges reporting increased BTC spot inflows, while altcoin trading pairs have seen a decline in both liquidity and momentum. This rotation typically signals investor caution, as market participants hedge against volatility by consolidating into Bitcoin.

Technical indicators suggest that the next resistance lies between 61.50% and 62.20%, marked by prior supply zones that triggered reversals earlier this year. A decisive break above that range could extend Bitcoin’s dominance toward 63%, a level last seen in early 2024.

However, altcoin traders remain watchful. “If dominance stalls around 61.5% and Bitcoin’s price stabilizes, we could see a short-term recovery in altcoins as capital re-enters high-beta assets,” another strategist noted.

The broader structure still favors Bitcoin strength in the near term, with the green support region around 57% acting as a strong base for continuation.

For now, market sentiment suggests a “Bitcoin-first” phase, as traders await macro clarity and potential catalysts for altcoin recovery.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.