BTC Dominance Technical Outlook Amid a 30% Market Pullback

Bitcoin’s recent 36% correction delivered a sweeping reset across the crypto market, yet its dominance chart reflected an uncharacteristic decline rather than the expected climb. Historically, sharp Bitcoin drawdowns push liquidity out of altcoins and into BTC, lifting dominance metrics. This cycle, however, the chart shows a clear deviation from that pattern, revealing a deeper market-wide deleveraging and a shift in capital behavior.

Unusual Dominance Behavior During Major BTC Drawdown

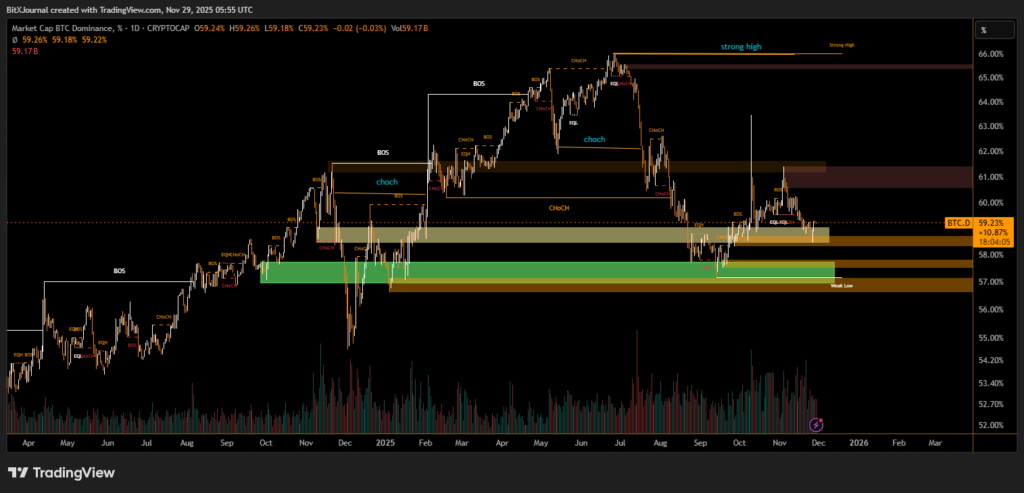

The latest dominance chart shows BTC.D sliding from its early-cycle highs above 65%, despite Bitcoin’s aggressive price decline. Multiple Break of Structure (BOS) events mark the erosion of bullish momentum, while repeated Change of Character (CHoCH) points signal structural weakening on the daily timeframe.

A key technical development is the breakdown toward the broad support zone between 57% and 58%, highlighted in green on the chart. This region has historically acted as a stabilizing band for Bitcoin dominance, aligning with prior liquidity pools formed during late-2024 and early-2025 consolidation. The move back into this zone indicates that capital flowed out of both Bitcoin and altcoins simultaneously, a trademark of forced unwinding rather than voluntary sector rotation.

The presence of equal lows and a marked weak low near the lower boundary of the support suggests that dominance may still face vulnerability if selling persists. Meanwhile, overhead supply zones near 61% and 63%—connections to previous distribution phases—represent the next major hurdles should dominance attempt a recovery.

Structural Signals Highlight Market Deleveraging

Throughout the market, the clustering of BOS and CHoCH signals underscores a period of indecision. This aligns with derivative market data showing reduced leverage and elevated liquidation events across both long and short positions. Unlike typical drawdowns where Bitcoin absorbs capital from alts, the structural breakdown here indicates broad risk-off sentiment, pulling liquidity out of the entire market.

The strong high positioned near 66% remains a distant target, likely requiring favorable macro catalysts and renewed Bitcoin-led momentum to revisit.

Dominance hovering near critical support leaves room for either continuation or a sharp mean reversion. A bounce from the 57%–58% region would signal stabilization, while a break below could open the door to the first sustained altcoin-led phase in months. Current technicals make it clear that Bitcoin’s dominance is no longer behaving in its traditional pattern, offering an early signal of shifting market dynamics heading into the next cycle.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.