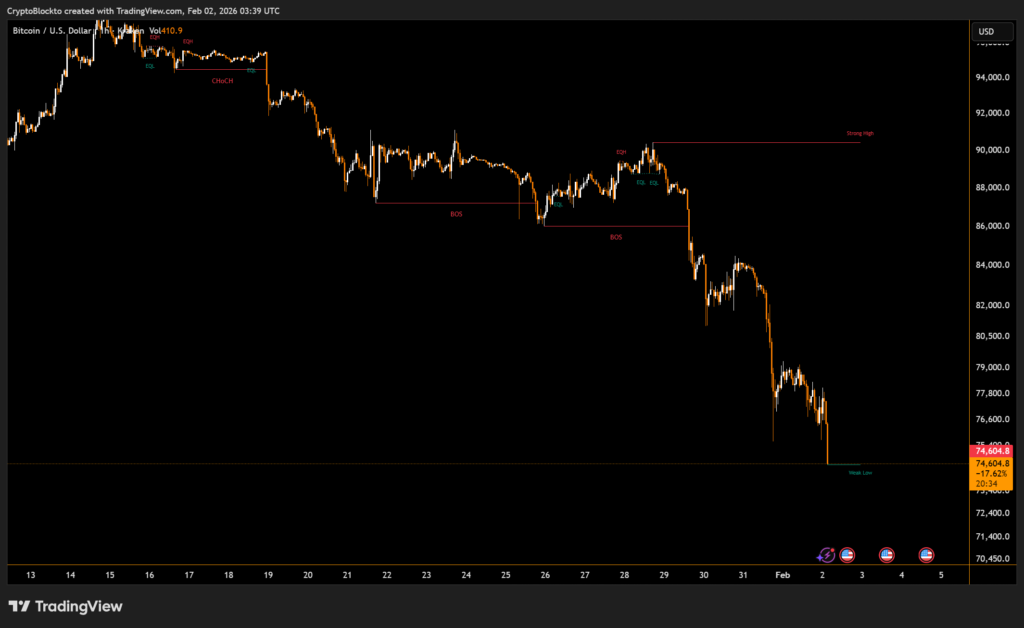

Bitcoin is trading below the $75,000 level after a sharp, liquidation-driven sell-off exposed a disconnect between fast-moving derivatives markets and slower prediction markets tied to month-end outcomes. While prediction contracts for January failed to fully price in the downside risk, derivatives traders moved quickly to hedge as selling pressure accelerated over the weekend.

Options market data showed a sudden spike in demand for downside protection, particularly put options with a $75,000 strike price. This shift signaled growing concern among traders that Bitcoin’s decline could deepen amid thin liquidity conditions.

Liquidations Highlight Leverage Risk in Crypto Markets

The sell-off triggered more than $500 million in liquidations of leveraged long positions, amplifying downward momentum. The bulk of these liquidations occurred during a low-liquidity weekend trading window, a period that has historically increased volatility across digital asset markets.

Broader Market Snapshot Across Assets

At last check, Bitcoin was hovering just under $80,000 following a modest rebound, while ether traded near $2,300. Traditional markets showed mixed signals, with Asian equities divided as investors balanced stronger-than-expected Chinese factory data against regional stock market weakness.

Meanwhile, gold retreated to around $4,750 per ounce after failing to sustain recent highs. The synchronized pullback across crypto and commodities suggests investors remain cautious, reassessing risk exposure as global macro signals continue to shift.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.