U.S. spot Bitcoin ETFs have extended their net inflow streak to 15 consecutive trading days, pulling in a cumulative $4.7 billion as of July 1, 2025. The momentum continues to build despite Bitcoin hovering just under 5% below its all-time high, signaling growing confidence from institutional investors.

Daily Analysis of $BTC by BITX

BlackRock Leads as ETF Inflows Top $100 Million on Monday

On the final day of June, Bitcoin ETFs attracted $102.1 million in net inflows, with BlackRock’s IBIT fund contributing $112.3 million. This was partially offset by a $10.2 million outflow from ARK Invest and 21Shares’ ARKB ETF.

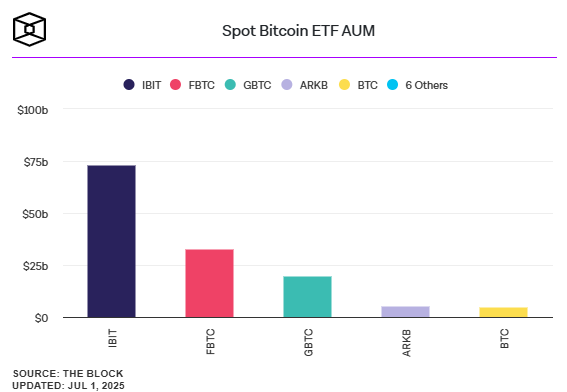

IBIT now accounts for 81% of the 15-day inflow streak, totaling $3.8 billion.

This surge has pushed the total assets under management (AUM) of all U.S. spot Bitcoin ETFs to nearly $128 billion, with cumulative inflows reaching $49.3 billion since launch in January 2024. Year-to-date net flows now stand at $13.8 billion.

ETF Demand Slows But Remains Strong

While Monday’s inflows were healthy, they marked a cooldown compared to last Friday’s $501.2 million spike and the $316 million daily average during the 15-day period. This suggests that while enthusiasm remains strong, short-term institutional momentum is beginning to wane.

Institutional demand may need new catalysts to push Bitcoin above $112,000.

Ethereum ETFs Also Gaining Traction

U.S. spot Ethereum ETFs recorded $31.8 million in net inflows, led by $25.7 million into Fidelity’s FETH fund. Despite launching in mid-2024, these funds have already attracted $4.2 billion in net inflows, showing Ethereum’s rising profile among asset managers.

Outlook: Momentum Slows as Macro Factors Loom

Bitcoin briefly crossed $108,000 over the weekend before settling around $106,700, while Ethereum trades near $2,457. Analysts point to upcoming macroeconomic data and Fed Chair Powell’s remarks as potential market movers this week.

Cooling ETF inflows suggest Bitcoin may struggle to breach $110,000 in the short term.

However, medium-term indicators remain bullish, especially as corporate treasuries accelerate Bitcoin accumulation and ETF participation broadens across institutions.

Sustained Demand but Slower Pace

The 15-day Bitcoin ETF inflow streak highlights continued institutional interest, though the slowing pace signals caution as Bitcoin trades near record levels. Without a new macro or regulatory catalyst, further upside may be limited in the short term—yet the medium- to long-term outlook remains constructive for digital asset exposure via ETFs.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.