Institutional apathy and persistent ETF outflows could undermine Bitcoin’s momentum, pushing the asset into a prolonged consolidation phase.

Bitcoin’s price stability is under pressure as U.S.-based spot Bitcoin ETFs continue to record substantial outflows following the recent crypto market downturn. Analysts from Bitfinex caution that a sustained lack of institutional buying could erode confidence and push Bitcoin below a critical $107,000–$108,000 support zone.

ETF Outflows Intensify Pressure on Bitcoin Support

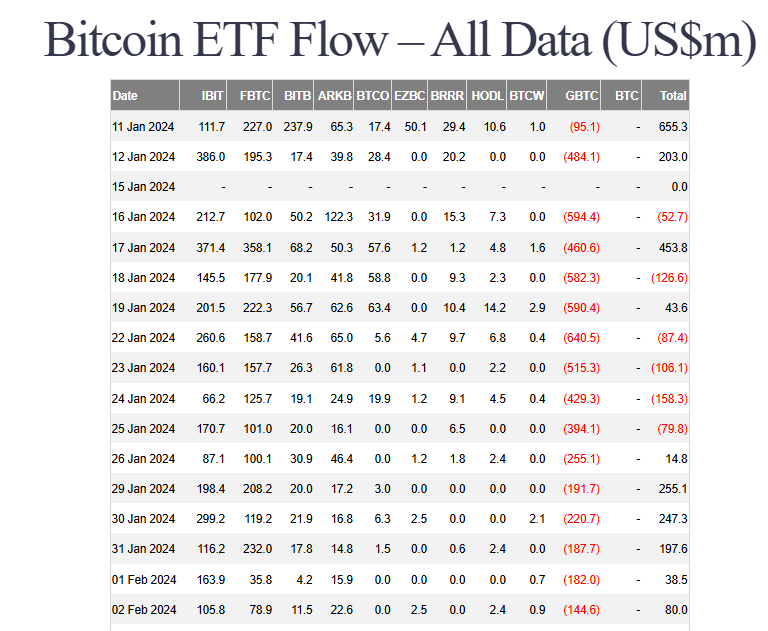

In a report published Tuesday, Bitfinex analysts highlighted that “the lack of institutional accumulation has made the $107,000 to $108,000 zone increasingly difficult to defend as support.” The warning comes after approximately $1.23 billion in net outflows from spot Bitcoin ETFs between October 13 and October 17, according to data from Farside.

The analysts noted that the exodus accelerated after U.S. President Donald Trump’s tariff announcement earlier this month, triggering broader market volatility. Despite this, strong inflows on Tuesday managed to bring total weekly net flows back into positive territory at around $335.4 million.

Still, the analysts warned that the current absence of meaningful dip-buying from institutional investors remains a major concern.

Bitcoin Mirrors Broader Financial Market Volatility

At the time of writing, Bitcoin trades near $108,864, having briefly surged above $113,000 earlier in the week before retracing. Bitfinex’s report described the asset’s price action as a “crucial point” that could determine whether Bitcoin enters an extended consolidation phase.

“If weakness persists or ETF inflows fail to recover meaningfully in the coming weeks, it would point to growing demand-side fragility,” analysts wrote. “Such a scenario could undermine one of the primary forces behind previous rallies — consistent institutional accumulation.”

Despite short-term pressure, several well-known market participants remain optimistic. BitMEX co-founder Arthur Hayes and BitMine chairman Tom Lee maintain predictions that Bitcoin could reach $250,000 before year-end, citing strong cyclical patterns and institutional momentum.

However, Galaxy Digital CEO Mike Novogratz offered a more conservative outlook, saying, “A lot of crazy stuff would have to happen for Bitcoin to hit $250,000 this year.” He added that even in a worst-case scenario, Bitcoin should still hold above $100,000 by year-end.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.