Institutional investors pull back amid sharp Bitcoin price swings and shifting rate expectations

U.S. spot Bitcoin exchange-traded funds (ETFs) recorded a massive $1.23 billion in outflows last week, signaling renewed caution among institutional investors as market volatility intensified. The withdrawal marks the second-largest weekly outflow since the products debuted in 2024, according to market data.

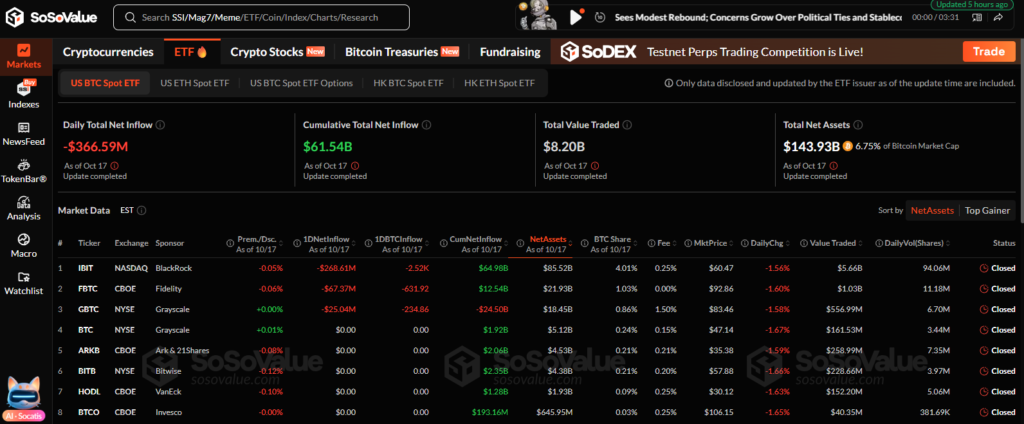

Outflows accelerated late in the week, with $366.6 million withdrawn on Friday alone, erasing a portion of the strong inflows seen earlier in October when investors added $2.7 billion to Bitcoin ETFs. Analysts note the shift represents a temporary flight from risk assets following Bitcoin’s sharp price correction.

Bitcoin fell from around $121,000 on October 10 to a low near $103,700 on October 17, before recovering above $111,000 over the weekend. The world’s largest cryptocurrency remains volatile, but its recent rebound of 4.2% indicates some traders are buying the dip amid expectations of improved liquidity.

“The recent ETF outflows reflect short-term uncertainty, not long-term bearishness,” said BITX senior digital asset strategist. “Institutional investors are recalibrating exposure after an intense rally and awaiting clearer signals on monetary policy.”

Meanwhile, Ethereum ETFs also mirrored the selling trend, posting $311.8 million in outflows, compared with $488.3 million in inflows the previous week. This parallel movement suggests broader investor hesitation across major digital assets rather than isolated weakness in Bitcoin.

Market observers attribute part of the retreat to shifting macroeconomic conditions. Federal Reserve Chair Jerome Powell recently acknowledged that economic growth remains strong but labor market softness persists, leading to speculation of a rate cut later this month.

“Lower bond yields and expectations of policy easing could support a rebound in risk assets like Bitcoin,” said Rachael Lucas, a crypto market analyst. “We’re entering a phase where liquidity conditions might again favor digital markets.”

As Bitcoin stabilizes above $111,000, traders are now watching whether the latest ETF outflows represent a short-term shakeout or a pause before the next leg higher in the ongoing bull cycle.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.