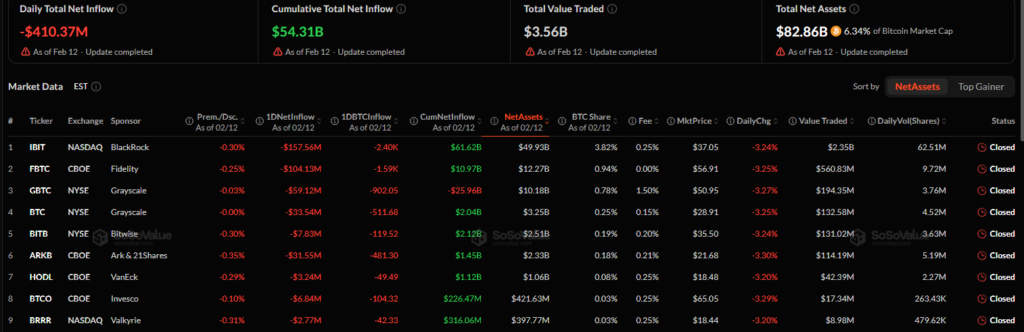

US spot Bitcoin ETFs posted $410.4 million in net outflows on Thursday, marking one of the largest single-day withdrawals in recent weeks. According to data from SoSoValue, total weekly outflows have reached $375.1 million, putting the funds on track for a fourth consecutive week of losses.

Assets under management have fallen from nearly $170 billion in October 2025 to around $80 billion. All 11 listed Bitcoin ETF products reported negative flows. The largest withdrawals came from BlackRock’s iShares Bitcoin Trust (IBIT) and the Fidelity Wise Origin Bitcoin Fund, which saw $157.6 million and $104.1 million in outflows, respectively.

Standard Chartered Lowers Bitcoin Target to $100,000

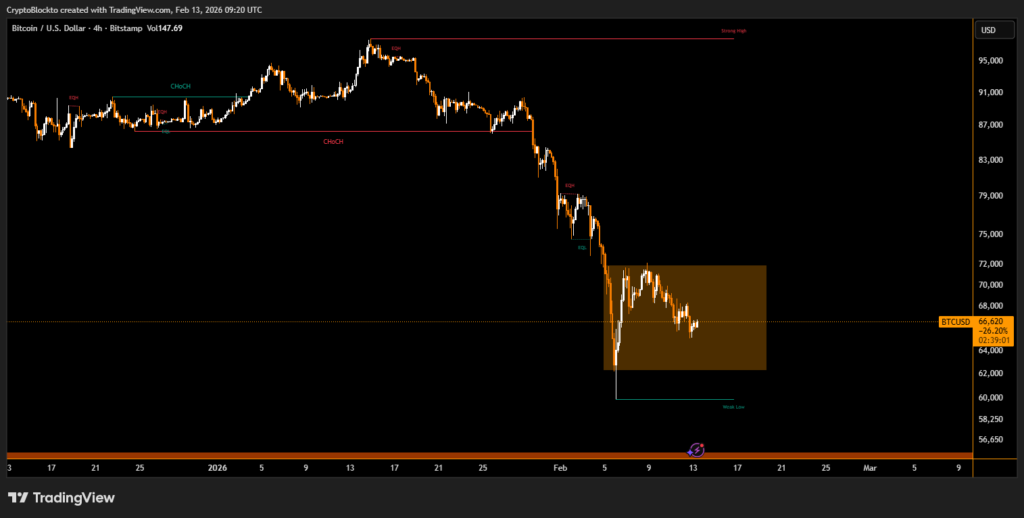

The heavy selling coincided with Standard Chartered revising its 2026 Bitcoin price target from $150,000 to $100,000. The bank warned that Bitcoin could fall to $50,000 in the coming months before stabilizing. It also projected Ether could decline to $1,400 before recovering toward $4,000 by year-end.

Bitcoin traded near $66,000 on Thursday, briefly touching $65,250.

Analysts See $55,000 as Key Support Level

Crypto analytics firm CryptoQuant estimates Bitcoin’s realized price support near $55,000. Analysts note that while the market remains in a bear phase, it has not yet entered an extreme capitulation stage typically associated with long-term bottoms. Long-term holders are currently selling near breakeven levels, suggesting further downside may be needed before a sustained recovery begins.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.