BTC rebounds above $92,000 as traders weigh Fed outlook and volatility risks

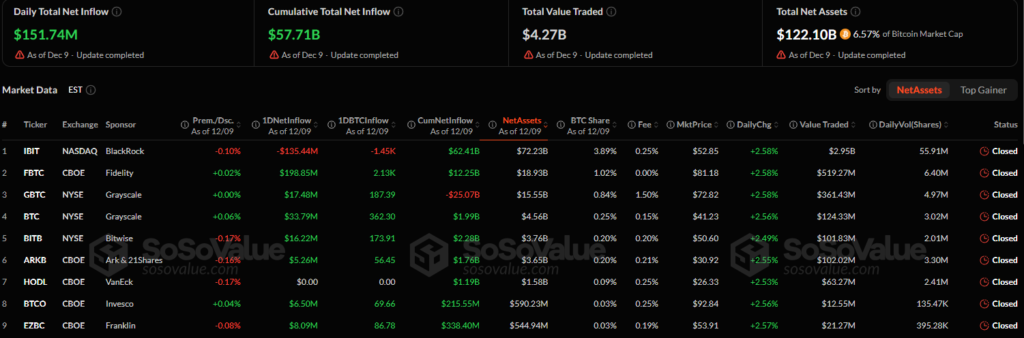

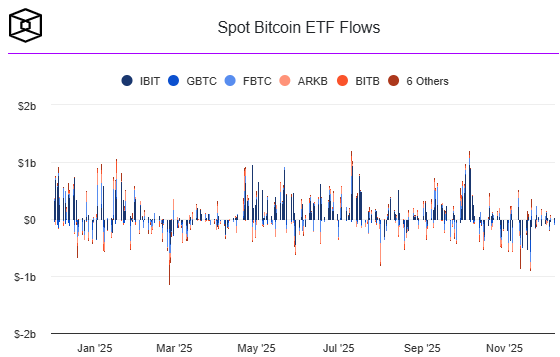

Bitcoin exchange-traded funds (ETFs) recorded a notable rebound on Tuesday, attracting $152 million in net inflows ahead of the Federal Reserve’s final policy decision of 2025. The surge was led by Fidelity’s FBTC fund, which alone drew $199 million, reversing several days of prior weakness. Ethereum and Solana ETFs also posted gains, with Ethereum adding $178 million and Solana $16.5 million in inflows.

The inflows coincided with a brief Bitcoin rally to $95,000, before consolidating in the $92,000–$93,000 range. Analysts attribute this movement to accumulation by whales and leveraged position resets, rather than a short-term squeeze. On-chain indicators suggest a constructive trend: exchange balances are falling, large wallets are net buyers, and overall market leverage has decreased from summer peaks, signaling a healthier structure.

Despite this rebound, market caution remains high. Historically, six of seven Fed meetings in 2025 triggered Bitcoin sell-offs, and derivatives markets reflect defensive positioning, with options skew showing elevated put premiums. Short liquidations of $317 million over the past 24 hours have already cleared speculative excess, while retail investors continue distributing into strength.

The market now closely watches the Fed’s 25-basis-point rate cut, which is largely priced in, and Powell’s tone on balance sheet guidance and 2026 policy. Analysts suggest that a dovish outlook could push Bitcoin toward $96,000–$106,000, while a cautious stance may return it to the mid-$80,000s. Global events, such as the Bank of Japan meeting on December 19, could further influence volatility in Bitcoin and other crypto assets.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.