Crypto markets brace for volatility as Bitcoin hovers near “max pain” level around $114,000

Bitcoin (BTC) and Ether (ETH) are heading into one of the largest monthly options expiries of 2025, with a combined $17 billion in contracts set to settle on Deribit this Friday. The event coincides with the Federal Reserve’s policy meeting and a week packed with U.S. tech company earnings, raising expectations for heightened market turbulence.

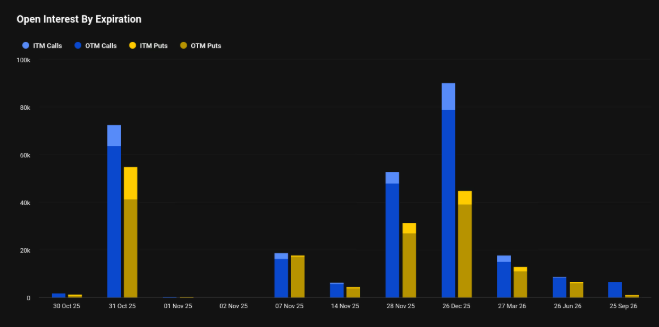

According to Deribit data, bitcoin options account for roughly $14.4 billion in open interest, while ether options total $2.6 billion. More than 72,000 BTC call contracts and 54,000 put contracts are due for expiry, reflecting intense speculative positioning across strike prices from $100,000 to $130,000.

“When options expiry coincides with major macro and earnings events, the short-term impact on volatility can be significant,” said Alex Kim, a derivatives strategist at OnChain Analytics. “Traders often hedge aggressively as expiry nears, which can cause price clustering around key strike zones.”

Bitcoin Nears ‘Max Pain’ at $114K

Currently trading around $113,000, bitcoin sits just below its max pain level — the price point where the greatest number of option contracts expire worthless.

This level, calculated at $114,000, represents where market makers experience the least losses, and is often viewed as a gravitational target ahead of expiry.

“We tend to see BTC drift toward max pain into expiry,” noted Kim, adding that it’s “not a guaranteed outcome, but a reflection of how hedging flows can influence spot prices.”

Out-of-the-money (OTM) options account for over 82% of open interest, showing traders’ preference for speculative, leveraged positions rather than simple hedges. Calls are concentrated near $120,000 and $130,000, while puts cluster around $100,000 and $110,000 — indicating expectations for a potential wide price range after expiry.

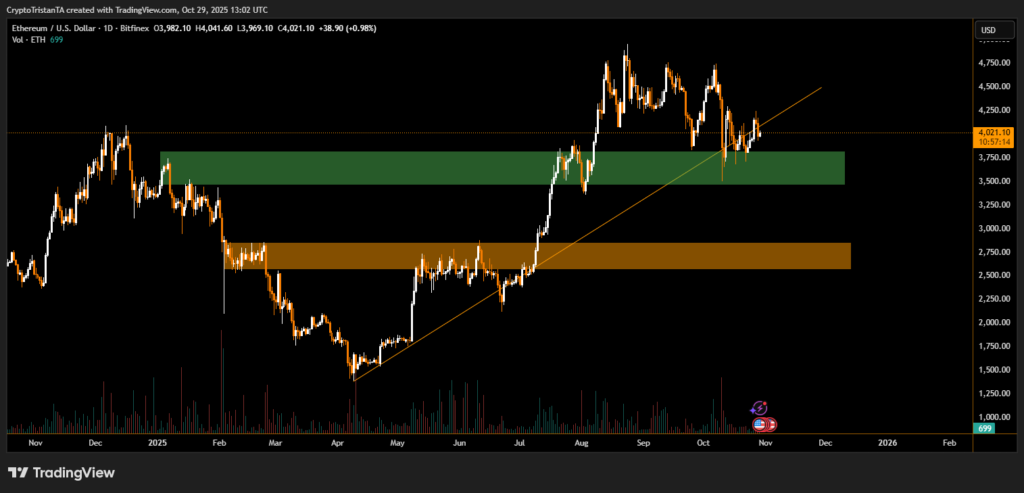

Ether Options Also Eye Volatility

For Ether, the picture is similar. Around 375,000 call options and 262,000 put options — worth a total notional of $2.6 billion — are set to expire, with a max pain level near $4,110, compared to current prices around $4,000.

Analysts say the outcome of the Federal Reserve’s rate decision and tech earnings from giants like Apple, Microsoft, and Alphabet could dictate whether crypto prices break higher or consolidate.

“Macro and micro factors are colliding this week,” said Daniel Park, head of research at BlockMetrics. “With both Bitcoin and Ether near max pain, traders should expect sharp swings as liquidity resets post-expiry.”

As $17 billion in options unwind, the interplay between Fed policy signals, equity sentiment, and crypto derivatives will likely define the next directional move for digital assets.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.