Crypto investment products swing back to inflows amid revived hopes for U.S. rate cuts

Economic Data Fuels Market Turnaround

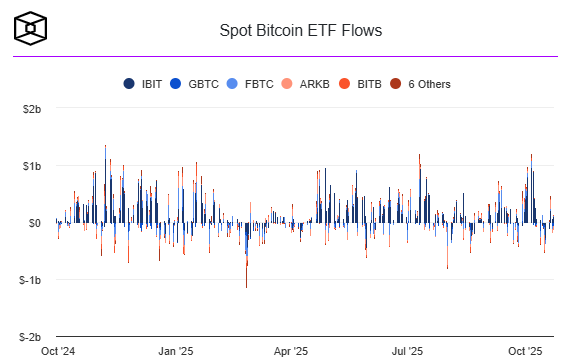

After weeks of steady outflows, Bitcoin exchange-traded products (ETPs) have bounced back strongly, posting $931 million in inflows last week. The rebound follows lower-than-expected U.S. inflation data, which renewed investor confidence in further Federal Reserve interest rate cuts, according to new figures from CoinShares.

Overall, crypto ETPs attracted $921 million in net inflows, fully offsetting the $513 million in outflows recorded the previous week—a clear signal of revived sentiment in the digital asset investment space.

Inflation Surprise Revives Crypto Appetite

The Consumer Price Index (CPI) rose 0.3% in September, placing the annual inflation rate at 3%, both readings below market forecasts. This unexpected moderation in inflation rekindled optimism that the Fed could proceed with additional rate reductions, boosting risk assets, including cryptocurrencies.

“The ongoing U.S. government shutdown and lack of key macroeconomic data left investors uncertain about monetary policy,” said James Butterfill, Head of Research at CoinShares. “However, the CPI data helped restore confidence in further rate cuts.”

With inflation easing, investors returned to Bitcoin-based products, reversing the prior week’s losses.

Bitcoin Leads the Rebound, While Ether Falters

Bitcoin (BTC), which had driven the bulk of the outflows earlier in the month, saw nearly full recovery with $931 million in new inflows, pushing total post-rate-cut inflows since September to $9.4 billion.

In contrast, Ether (ETH) experienced its first weekly outflow in five weeks, totaling $169 million, despite continued demand for leveraged ETPs.

Among altcoins, Solana (SOL) and XRP products recorded $29.4 million and $84.3 million in inflows, respectively — though Solana’s numbers reflected an 81% decline from the previous week, suggesting investor caution ahead of upcoming U.S. ETF launches.

As of last week, total assets under management (AUM) in crypto investment products climbed to $229 billion, with $48.9 billion in cumulative inflows so far in 2025.

Still, despite the sharp rebound, Bitcoin funds’ year-to-date inflows of $30.2 billion remain 38% below last year’s $41.6 billion, highlighting that while institutional interest is reviving, the sector continues to face cautious capital flows.

The renewed inflows underscore how macroeconomic shifts — particularly easing inflation — continue to steer digital asset investment trends, reaffirming Bitcoin’s role as a leading indicator of crypto market sentiment.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.