Market Weakness Deepens as Price Breaks Key Structural Levels

Bitcoin has slipped back below $89,500, erasing Tuesday’s brief outperformance and renewing concerns about deeper downside in the days ahead. Technical analysts say the market’s recent structure suggests that sellers remain firmly in control, with several indicators pointing toward a potential local bottom in the $84,000–$86,000 region.

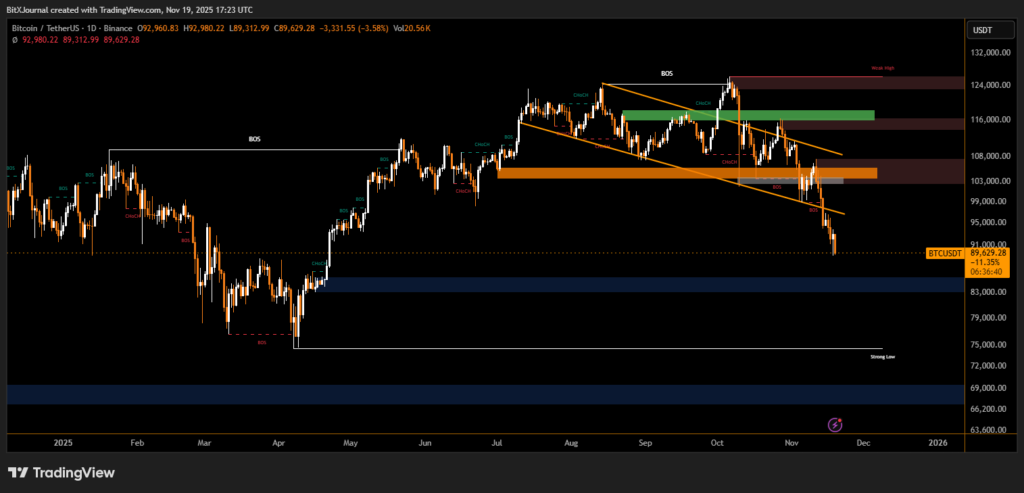

The daily chart shows Bitcoin breaking down from a descending channel, losing multiple short-term support zones and triggering a series of breaks of structure (BOS). Price has also fallen through a previously defended demand region around $92,000–$94,000, confirming bearish momentum.

“The market is following a clear pattern of lower highs and lower lows, and the recent BOS confirms the continuation of the downtrend,” said BitXJournal technical analyst tracking liquidity flows. “If current weakness continues, the next major reaction zone sits in the mid-$80,000 range.”

Several confluence levels on the chart — including liquidity gaps, historical demand zones, and unmitigated imbalances — align around $84,000–$86,000, making it a high-probability area for a potential bounce.

Technical Indicators Signal Further Pressure

The chart you provided shows Bitcoin breaking below the lower boundary of its short-term channel while tapping into a minor liquidity pocket. Analysts note that the broader structure remains bearish, with a clear displacement away from the most recent supply zones.

BitXJournal senior market strategist explained:

“BTC failed to reclaim the $103K–$108K supply area, and that rejection played a major role in accelerating the current sell-off. Until the market closes back above that region, upside recovery will likely remain limited.”

In addition, Bitcoin is hovering just above a major higher-time-frame demand block near $83,000, which has acted as a strong floor in previous cycles.

If price taps that region, traders expect heightened volatility as both long-term buyers and trend followers react to the liquidity cluster.

While the broader trend remains under pressure, analysts emphasize that the $84K–$86K zone could serve as a stabilization point if buyers re-enter with conviction. Until then, the market is expected to remain highly reactive to macro sentiment and liquidity-driven volatility.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.