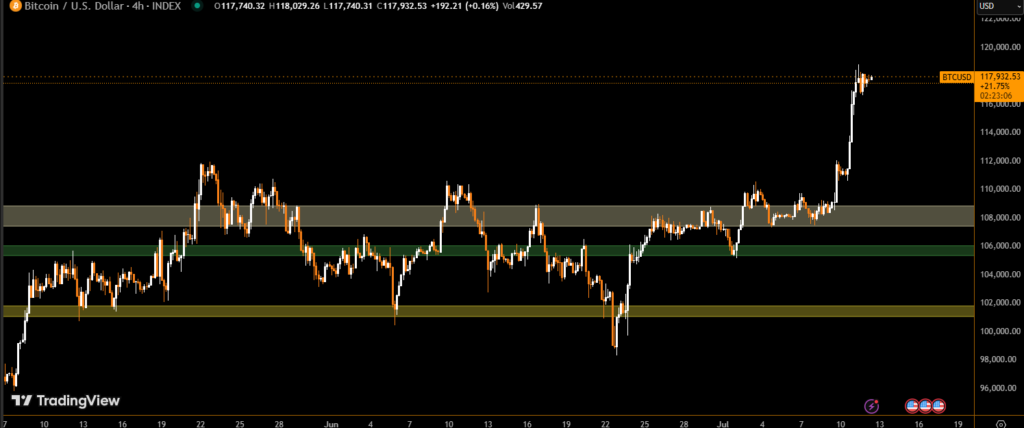

Bitcoin (BTC) surged past $120,000 this week, marking a significant milestone in the ongoing crypto bull market. The price movement was supported by strong inflows into U.S.-based spot Bitcoin ETFs, corporate treasury purchases, and tight supply conditions.

Institutional investors continue to accumulate BTC, creating consistent upward pressure on price. Analysts now suggest that Bitcoin could reach $130,000 if the $120K–$122K resistance zone is decisively broken.

Ethereum Gains Momentum with Price Approaching $3,000

Ethereum (ETH) followed closely behind Bitcoin’s rally, climbing over 17% in the past seven days. ETH briefly crossed $3,000, driven by increased capital flows from institutions and traders looking to diversify after BTC’s rally.

The second-largest cryptocurrency is benefiting from renewed interest in staking, smart contracts, and tokenization use cases.

Solana and Dogecoin Lead the Altcoin Rally

Solana (SOL) is trading around $163, gaining more than 11% this week. The asset has seen increased demand from retail traders, especially across decentralized platforms and meme coin projects built on its network.

Dogecoin (DOGE) surged over 23%, reflecting rising retail activity on trading apps and centralized exchanges. DOGE continues to act as a high-beta asset, often outperforming during speculative bull runs.

XRP Volume Spikes as Price Jumps 25%

XRP experienced a strong technical breakout, climbing 25% amid rising trading volume. Notably, a significant share of the volume spike occurred on Asian crypto exchanges, suggesting broader global participation in this rally.

Market participants are speculating on a favorable regulatory outcome for Ripple, further supporting the bullish sentiment around XRP.

Altcoin Season May Be Just Beginning

Despite major altcoins surging, Bitcoin dominance remains above 64%, indicating that altcoin season may not be in full effect yet.

Analysts believe that if BTC dominance drops toward 45%, a much larger altcoin breakout could occur.

Final Thoughts: Bull Market Driven by Real Demand

The current crypto rally is not just speculation. It is underpinned by real capital inflows, macroeconomic tailwinds, and institutional adoption.

Bitcoin is emerging as a macro hedge, and leading altcoins are showing strong structural support. As long as these conditions persist, the market appears primed for continued growth.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.