Market Eyes $80K Demand Zone After Sharp Pullback From Major Resistance

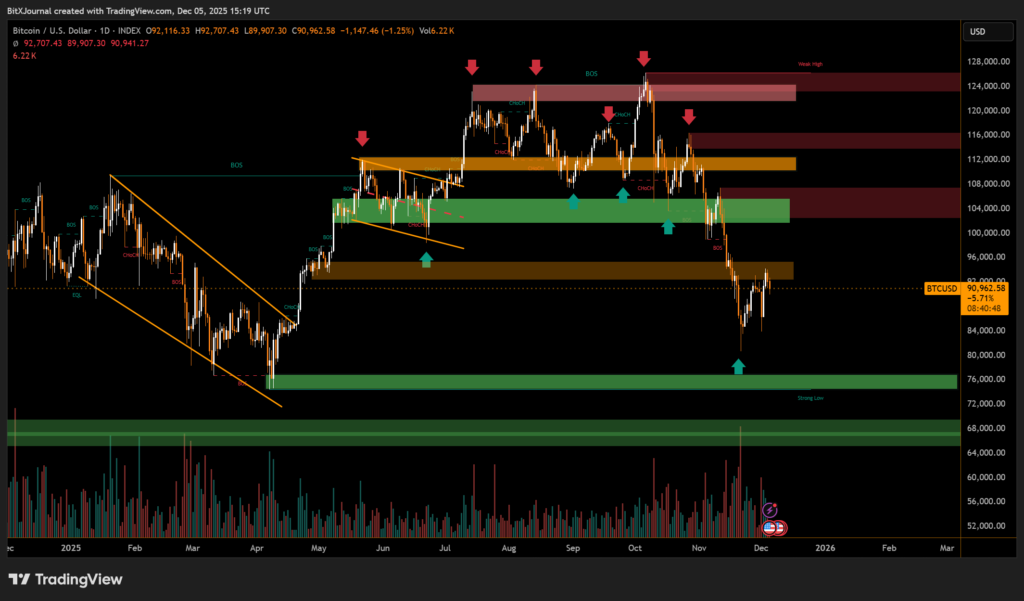

Bitcoin’s latest pullback has triggered renewed caution across the market, with traders increasingly revisiting sub-$90,000 price targets as weakness continues to unfold. The move follows a clear rejection near the yearly open zone, where selling pressure once again capped the asset’s attempts to regain upside momentum.

The current market structure shows Bitcoin retreating from a dense cluster of supply between $112,000 and $120,000, an area that has repeatedly acted as a ceiling throughout the year. Multiple rejections marked by consecutive swing highs reinforce the importance of this region, where liquidity has consistently been absorbed by sellers.

As price slipped below the mid-range levels highlighted attention has shifted toward the deeper demand zones. The $80,000–$82,000 region stands out as a critical area, historically attracting strong buyer interest. A clean retest of this structure, analysts note, would align with broader market positioning, especially after the accelerated downside seen over recent sessions.

Trading activity reinforces this narrative. Volume surged on recent down days, suggesting active distribution as Bitcoin failed to reclaim the orange resistance band near $96,000–$100,000. The transition back into lower structure, combined with repeated breaks of short-term support, supports the view that the current dip remains technically justified.

Market participants stress that a move toward the low-$80K zone remains a realistic scenario, particularly if Bitcoin loses momentum around current levels. Still, the broader trend structure remains intact over the higher time frames, leaving room for buyers to re-enter should price revisit major demand.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.