Despite nearly 17% losses in November, analysts suggest Bitcoin’s downturn sets the stage for long-term accumulation and a strong start to 2026.

Bitcoin is on track to close November at its worst monthly loss since at least 2019, down approximately 16.9%, trading around $91,500. This decline mirrors November 2019, when BTC lost 17.3%, and follows a series of weaker Novembers including 2018’s historic 36.5% drop during the post-2017 bear market.

Analysts note that November is typically one of Bitcoin’s strongest months, making this decline notable. Crypto educator Sumit Kapoor commented that, with the slow holiday period approaching, Bitcoin is set for its worst November in nearly seven years.

Capitulation Clears the Market for Long-Term Holders

Nick Ruck, research director at LVRG, said the month’s downturn clears out overleveraged participants and unsustainable projects, creating opportunities for new long-term investors to scale in. He described it as a capitulation phase that could set the stage for a promising 2026.

Similarly, Arctic Digital’s Justin d’Anethan highlighted that crypto-native investors often follow a predictable four-year cycle, where year-end rallies occur after consolidation periods. He noted that early 2024 spot Bitcoin ETFs accelerated this cycle, introducing institutional involvement that changes the pace and timing of price action.

Technical Outlook for Year-End

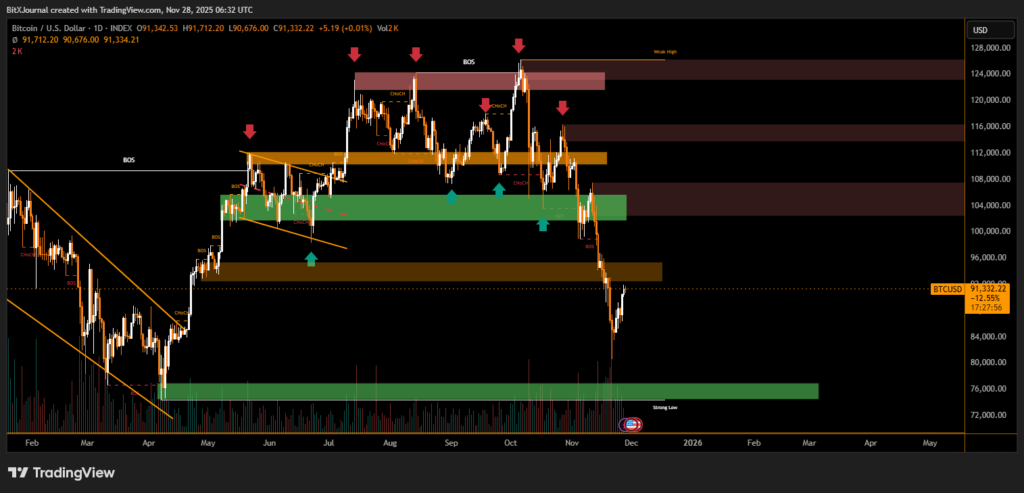

Analysts are monitoring key technical levels as Bitcoin approaches the monthly candle close. According to “CrediBull Crypto,” $93,000 is the first critical level, with a monthly close above it signaling a positive outlook. The next significant resistance is $102,437, which, if breached, would indicate strong bullish momentum, though this may not occur until next month.

At the time of reporting, BTC traded flat near $91,600, failing to break the resistance just below $92,000, but analysts remain cautiously optimistic that the long-term uptrend could remain intact if a higher low forms.

Despite a historically weak November, analysts emphasize that market consolidation often precedes new accumulation phases, positioning Bitcoin for a potentially strong start to 2026. The combination of cleared speculative positions and ongoing institutional participation suggests that strategic buying opportunities may emerge, reinforcing long-term bullish sentiment for the cryptocurrency.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.