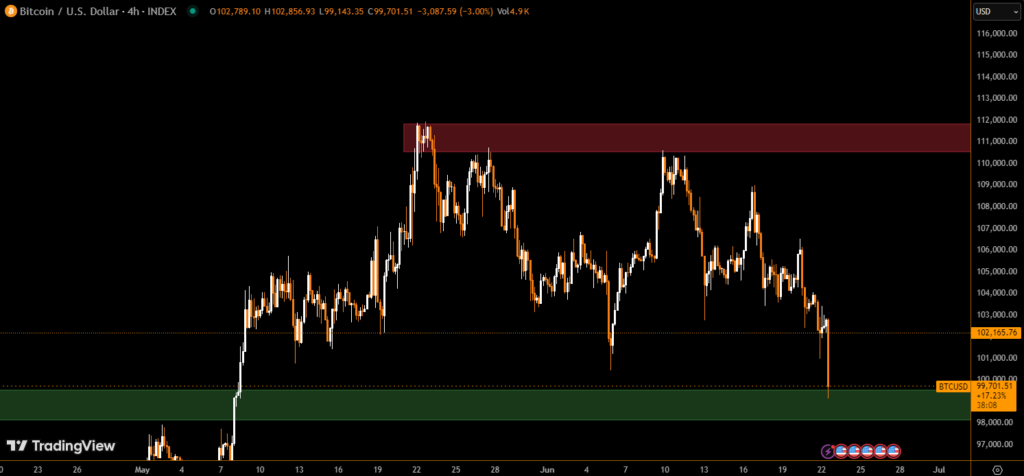

Bitcoin (BTC) dropped below the $100,000 mark on Sunday, hitting its lowest price since May, as escalating geopolitical tensions involving Iran triggered a risk-off sentiment across Wall Street. This dip, fueled by concerns over a potential closure of the Strait of Hormuz, also dragged major altcoins like Ethereum (ETH), XRP, and Solana (SOL) into the red.

Oil Supply Shock Looms Over Markets

The Strait of Hormuz, which handles about 20% of the world’s oil shipments, is at the center of rising global anxiety. Located between Oman and Iran, the strait is one of the most critical arteries for international energy trade.

Reports suggest that Iranian lawmakers are considering blocking the passage in retaliation to recent U.S. military strikes on nuclear facilities. Though the final decision rests with Iran’s Supreme National Security Council, over 50 oil tankers were reported fleeing the area, according to updates shared by The Kobeissi Letter on X.

“Markets have been closed, but an immediate drop in supply is expected to send prices higher. JP Morgan described this as their worst-case scenario in the Israel-Iran war,” the post stated.

JPMorgan analysts warn that oil could surge to $120–$130 per barrel, potentially driving U.S. inflation back up to 5%, levels not seen since March 2023. This outlook could pressure the Federal Reserve to delay interest rate cuts or even resume tightening.

Crypto Market Follows Bitcoin’s Lead

As is typical, Bitcoin’s breakdown below $100K exerted downward pressure across the broader digital asset market:

- XRP fell 6% to $1.935, marking its lowest level since April 10.

- Ethereum’s ETH dropped back to early-May levels.

- Solana (SOL) also declined, following the broader downtrend.

The price action reflects a wider risk-off sentiment, with crypto markets reacting similarly to traditional equities when faced with macroeconomic and geopolitical instability.

Wall Street Braces for Volatile Monday

With equity markets set to open following the weekend’s dramatic headlines, analysts anticipate a volatile start to the week, with energy stocks likely to surge and tech and crypto assets under pressure.

If the Strait of Hormuz is officially closed, Bitcoin could test deeper support levels, while oil-driven inflation fears might weigh on risk assets across the board.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.