Bitcoin has dropped out of the world’s top 10 investable assets after a wave of leveraged liquidations erased hundreds of billions in value. The sharp correction highlights ongoing volatility in cryptocurrency markets and signals challenges for Bitcoin’s resilience amid macroeconomic and market pressures.

Market Capitalization Decline

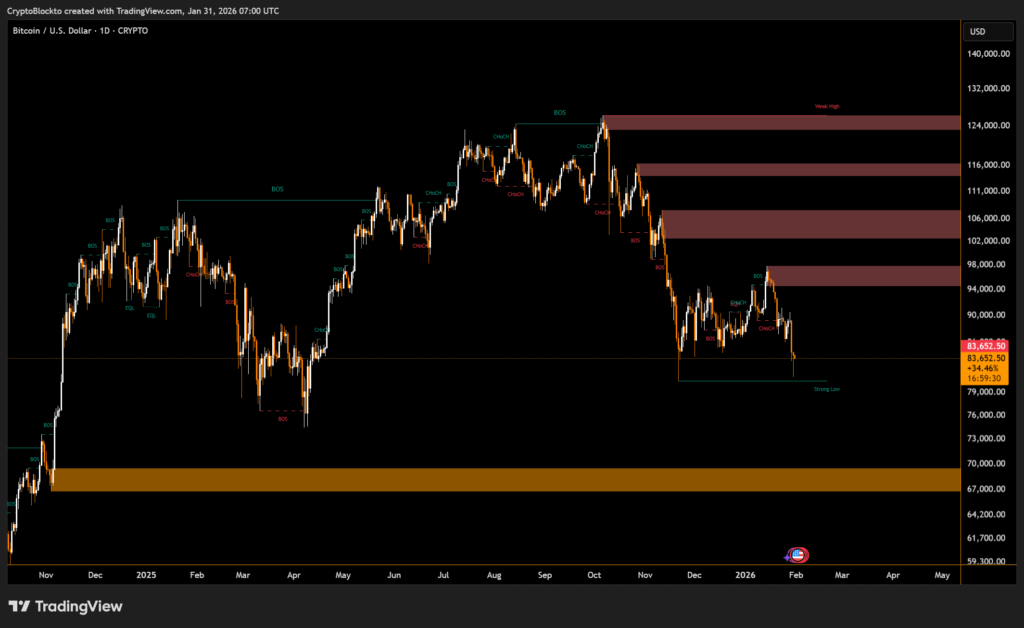

Bitcoin’s price has fallen to around $83,000 per coin, reducing its market capitalization to approximately $1.65 trillion. This places it 11th globally, just behind Saudi Aramco and Taiwan Semiconductor Manufacturing Co. The cryptocurrency had briefly reached a market cap near $2.5 trillion in October, when prices peaked above $126,000.

The recent sell-off was driven by roughly $1.6 billion in long liquidations, causing Bitcoin’s value to fall below $82,000 from near $90,000. The decline has renewed concerns that Bitcoin may be entering a prolonged bearish phase despite previously supportive market conditions.

Comparison with Other Assets

Meanwhile, gold has surged to the world’s largest asset following a record rally, with futures activity growing significantly. Bitcoin’s underperformance extends to other risk assets, including equities, despite a weaker US dollar and macro conditions that might have supported cryptocurrency gains.

Analysts suggest that Bitcoin’s recovery in 2026 depends on factors beyond short-term price movements, including increased participation from exchange-traded funds and corporate digital-asset holdings. Sustained inflows into Bitcoin and Ether could create a wealth effect that benefits the broader cryptocurrency market, but the path to recovery remains uncertain.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.