Bitcoin’s decline to $110,487 reflects heightened uncertainty in global markets as traders brace for the Federal Reserve’s interest rate decision and shifting macroeconomic signals.

Bitcoin (BTC/USD) extended its recent pullback, dropping below the key $110,000 level to trade around $110,487, marking a 2.2% decline in 24 hours. The move underscores growing market volatility ahead of the Federal Open Market Committee (FOMC) meeting, where policymakers are expected to outline their stance on interest rates amid persistent inflation and a fragile risk environment.

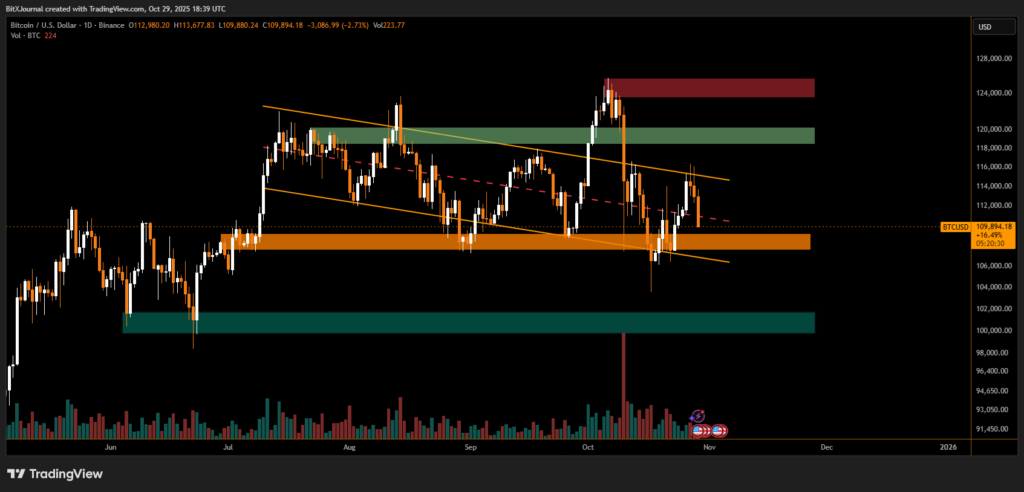

The latest daily chart shows BTC retracing from the $113,500 intraday high, slipping back into the orange support band near $108K, which has served as a pivotal zone for both buyers and sellers since mid-year. The formation of a descending channel—outlined by parallel yellow trendlines—suggests Bitcoin remains under short-term bearish pressure after failing to sustain momentum above the mid-range resistance near $118K.

Analysts point to macroeconomic jitters as the primary catalyst behind the increased volatility. “Bitcoin’s latest drop is part of a broader risk-off move across assets. With the FOMC decision imminent, traders are reducing exposure ahead of potentially hawkish commentary from the Fed,” BitXJournal market strategist explained.

The volatility index across crypto markets has spiked sharply over the past 24 hours, coinciding with increased spot-to-derivative volume flows—a signal that institutional traders are hedging positions. A breakdown below $110K could open the door to the next major support around $105K–$106K, while any dovish surprise from the Fed could trigger a swift rebound back toward $115K.

“Bitcoin has been oscillating between $105K and $118K for weeks, and macro catalysts are now the key drivers. If rates remain unchanged but the Fed signals flexibility, we could see renewed upside momentum,” BitXJournal analyst added.

As Bitcoin hovers just above $110K, the market remains on edge with traders watching both technical levels and economic headlines. The next 24 hours could determine whether BTC holds the orange support zone or retests the deeper green accumulation area near $100K. For now, volatility and uncertainty define the crypto landscape, as Bitcoin awaits direction from the Federal Reserve.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.