A sharp unwind in leveraged long positions sends Bitcoin into a critical demand region, raising questions about short-term momentum and liquidity conditions.

Bitcoin slipped to $96,000 in early trading as nearly $880 million in leveraged long positions were flushed out across major derivatives platforms. The decline pushed the asset into a historically reactive support area, where buyers have previously defended trend structure. Market observers say the latest move reflects a combination of liquidity stress, failed bullish continuation, and renewed selling pressure around higher-timeframe supply zones.

Bitcoin Support Levels Under Pressure

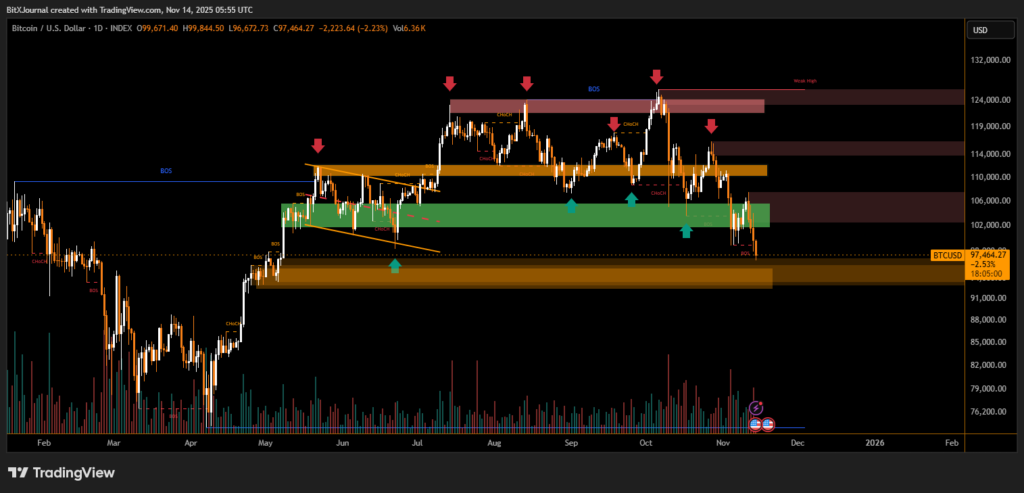

The chart shows BTC breaking below the $101,000–$103,000 region, an area that had acted as a mid-range floor for multiple weeks. This drop followed repeated rejections from upper supply zones between $118,000 and $124,000, where sellers consistently stepped in.

A series of break-of-structure (BOS) and change-of-character (CHoCH) signals indicated weakening bullish momentum well before the liquidation wave accelerated the decline. The market has now returned to a broad $94,500–$97,000 demand zone, which aligns with previous accumulation phases.

BitXJournal derivatives analyst noted, “The unwind was expected. Open interest had climbed to levels that typically precede volatility spikes. Once the $102,000 floor gave out, forced selling took over.”

BitXJournal market specialist pointed to the technical confluence: “Bitcoin is still reacting inside a major demand block. If buyers cannot hold this region, the next liquidity sweep could stretch toward deeper levels near $92,000.”

Leverage Reset May Support a Short-Term Stabilization

Despite the sharp pullback, some analysts argue the correction may improve market structure. With speculative positioning reset and funding rates normalizing, Bitcoin could stabilize if the $96,000 zone continues to attract reactive buying.

However, the chart shows that every attempt to break above $114,000–$118,000 has been met with immediate selling, suggesting that supply remains dominant until a clear structural shift occurs.

For now, the market will be watching whether Bitcoin can maintain support above $95,000 and form a higher-timeframe rejection wick, a pattern that has historically marked local bottoms.

A clean recovery toward $103,000 would signal regained strength, while failure to hold current levels could open the door to a broader retracement.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.