Bitcoin sentiment has turned sharply negative as the price trends lower, reflecting growing anxiety among traders after the asset fell to its weakest level in more than two months.

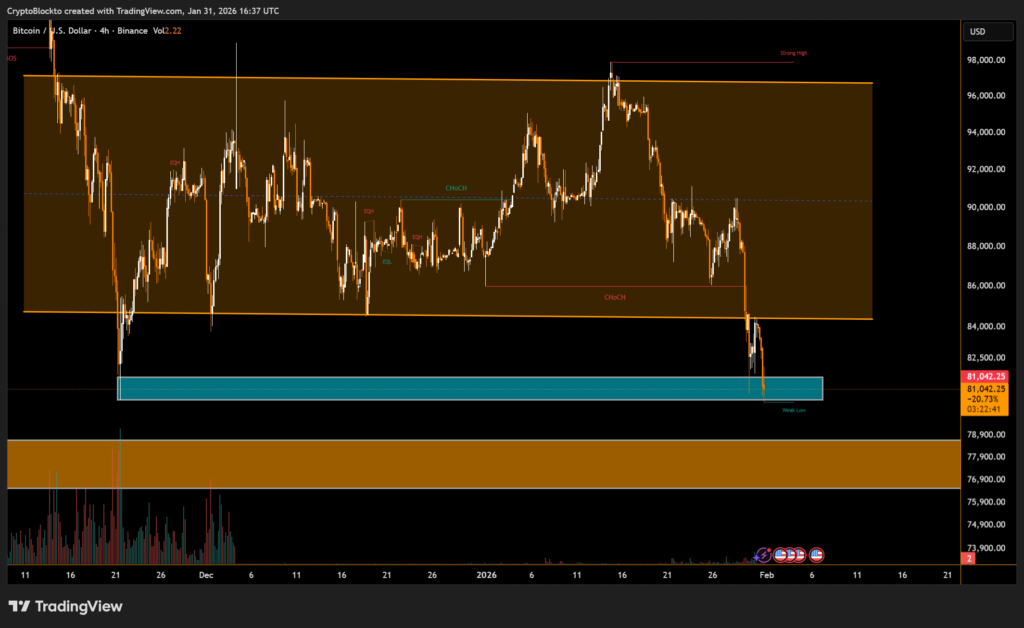

Bitcoin declined to around $81,000, marking its lowest price since late November. The drop triggered a wave of pessimism across social media platforms, pushing market sentiment to its most fearful reading of 2026 so far.

The shift represents a clear move from cautious optimism to outright fear, a pattern that often emerges when traders who entered late begin exiting positions under pressure. These moments typically coincide with forced selling caused by leverage unwinding and margin calls.

Capitulation Signals May Be Forming

Extreme fear does not guarantee an immediate rebound, but historically it has appeared near points where selling pressure starts to exhaust itself. When negative sentiment becomes overcrowded, markets can struggle to find new sellers, limiting additional downside.

Analysts note that bitcoin’s ability to stabilize will depend on whether it can reclaim and hold key psychological levels, particularly near $90,000. Failure to do so could prolong volatility.

Broader Market Weakness Adds Pressure

The crypto pullback comes amid wider risk-off behavior across global markets. Recent corrections in equities and precious metals have reduced liquidity and increased caution, contributing to choppy price action in digital assets.

If fear begins to ease and prices stabilize, the same traders expressing concern today could quickly return as buyers, potentially setting the stage for a recovery.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.