Bitcoin (BTC) transaction fees have surged to their highest levels in 2025, driven by increased network activity and growing interest as the cryptocurrency approaches its recent $106,000 price top. This spike comes amid a broader bullish trend that has captivated investors and reignited mainstream attention on the world’s largest cryptocurrency.

Record-High Fees in 2025

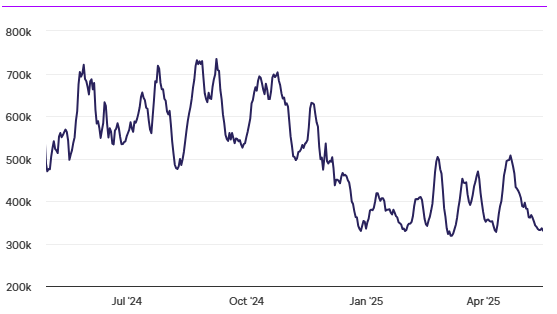

According to on-chain data, average Bitcoin transaction fees have climbed over $40, marking the highest point seen this year. The surge in fees is a direct result of heightened demand for block space, largely due to increased trading activity, speculative interest, and the continued rise of Bitcoin-based protocols and token inscriptions.

“The mempool is clogged again,” one analyst noted, referring to the backlog of unconfirmed transactions. When more users compete to get their transactions confirmed quickly, they attach higher fees — driving the average upward.

Transaction on the Bitcoin Network

BTC Price Challenges $106,000 Resistance

Meanwhile, Bitcoin’s price has once again tested the $106,000 resistance level, following weeks of consolidation between $95,000 and $102,000. This recent move suggests strong bullish momentum, potentially fueled by growing institutional interest, positive regulatory developments, and upcoming Bitcoin ETF inflows.

Traders are closely watching the $106,000 zone, which previously acted as a strong resistance level. A successful breakout above this could pave the way toward the next psychological target at $110,000.

Why Fees Are Rising

Several factors are contributing to the fee hike:

- Increased network activity from traders and developers.

- Rising popularity of Bitcoin Ordinals and layer-2 tokens, which consume significant block space.

- Speculation around upcoming protocol upgrades and events like Bitcoin halving discussions.

While rising fees are often seen as a sign of healthy demand, they can discourage smaller users from making on-chain transactions, especially for low-value transfers.

What This Means for Investors

For long-term holders, the current environment signals renewed interest and growing adoption. However, for active users, the cost of transacting on Bitcoin has become significantly higher, prompting many to explore layer-2 solutions like the Lightning Network for cheaper and faster transactions.

Conclusion

As Bitcoin tests the $106,000 resistance and transaction fees hit 2025 highs, the market is clearly heating up. Whether BTC breaks out or consolidates again, one thing is certain — Bitcoin is back in the spotlight, and all eyes are on the next big move.