On-chain cost basis data reveals why the $80,000 level has become a critical demand zone for Bitcoin investors

Bitcoin has shown renewed strength after correcting from its recent all-time high, with price action confirming strong structural support in the low $80,000 range. Following a sharp pullback, Bitcoin rebounded more than 15% from its November lows, reinforcing confidence among market participants.

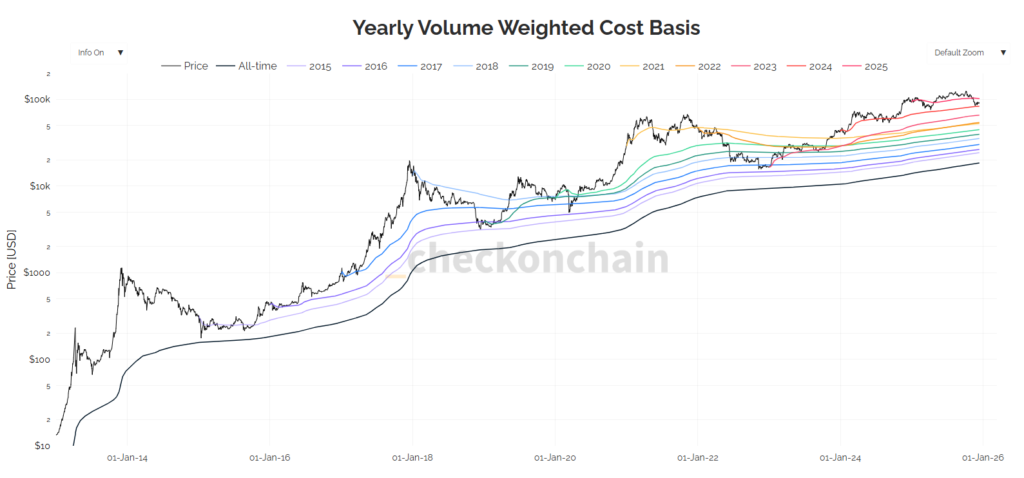

This support zone is validated by the convergence of three major on-chain cost basis metrics, each representing different but influential investor groups. Together, they highlight where capital is most likely to defend positions during market stress.

The first is the True Market Mean which reflects the average acquisition price of actively traded coins. During the correction, this metric hovered near $81,000_ a level Bitcoin has respected since late 2023, underlining its role as a long-term bull market threshold.

The second metric, the U.S. spot ETF cost basis, tracks the average price at which Bitcoin entered exchange-traded funds. Currently near _ $83,800 this level once again acted as support, suggesting institutional investors continue to defend their entry prices.

Finally, the 2024 yearly volume-weighted cost basis, around $83,000_ represents the average price of coins accumulated this year. Historically, such yearly cost bases act as support during bullish cycles, and recent price behavior confirms this pattern.

Together, these data points underscore deep demand and strong conviction around the $80,000 region, marking it as a pivotal support zone in the current market structure.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.