Bitcoin’s network experienced a noticeable stress test this week as a severe U.S. winter storm temporarily disrupted mining operations, causing a sharp decline in computing power. While markets remained calm, the incident highlights deeper structural issues within the Bitcoin mining ecosystem that researchers have warned about for years.

Bitcoin Hashrate Decline Explained

During the storm, Bitcoin’s hashrate fell by approximately 10%, reflecting a sudden loss of active mining power. Hashrate measures the total computational capacity securing the network and processing transactions. A rapid decline can lead to slower block production and, if prolonged, higher transaction fees until the next difficulty adjustment.

Despite the disruption, the blockchain continued operating normally, showing resilience in the short term.

Mining Centralization and Network Risk

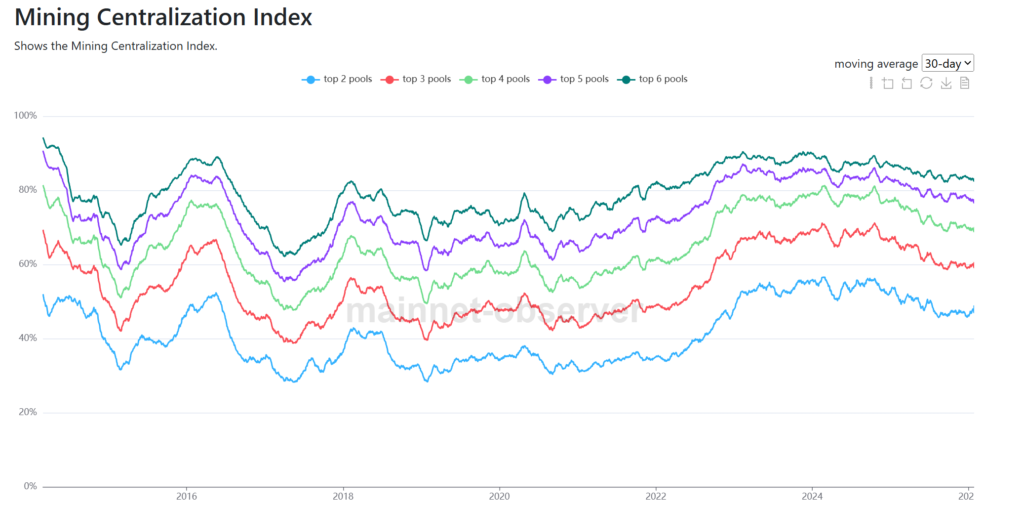

Academic research has shown that when mining activity is geographically or organizationally concentrated, local infrastructure failures can escalate into network-wide performance issues. A well-documented regional outage in 2021 demonstrated how concentrated mining led to longer confirmation times and degraded market conditions.

Today, this risk is amplified. A small number of mining pools now control the majority of Bitcoin’s block production, limiting the network’s ability to absorb regional shocks.

Bitcoin’s price showed little immediate reaction to the hashrate drop, suggesting traders view the event as temporary. However, the episode underscores a critical reality: physical infrastructure failures can stress the Bitcoin network without instantly affecting price.

As mining concentration continues to rise, similar events may carry greater long-term implications for network stability and transaction efficiency.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.