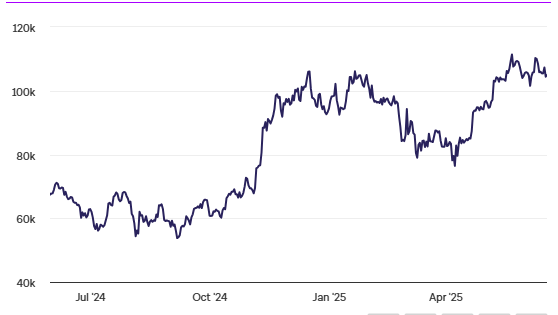

Bitcoin is solidifying its position above $100,000, with top analysts suggesting that this level is no longer just support — it is becoming the new psychological baseline for investors.

Despite a mix of geopolitical tensions and tight Federal Reserve policy, Bitcoin has remained resilient, trading above $100,000 for over five weeks. This steady performance underscores its growing status as both a macro hedge and a long-term treasury reserve asset.

Institutions Signal Confidence Amid Uncertainty

Elliot Johnson, CEO of the recently launched Bitcoin Treasury Corporation, emphasized BTC’s strength during recent global and economic volatility. “Bitcoin has remained incredibly resilient,” he noted, calling the $100K level “firmly established.”

The Federal Reserve’s decision to hold rates steady this week while projecting only one rate cut in 2025 surprised markets. While equities and bonds stalled, Bitcoin showed strength, highlighting its non-correlated behavior in times of uncertainty.

Michael Saylor’s Strategy — still the largest corporate holder of Bitcoin — added another $1.05 billion in BTC last week, reflecting ongoing institutional accumulation.

Bitcoin as a Safe-Haven and Treasury Asset

“Bitcoin is proving to be more than a speculative asset,” Johnson explained. “It’s emerging as a safe haven alternative to the weakening U.S. dollar.”

This sentiment is echoed by analysts who see Bitcoin as a long-term hedge against inflation, currency debasement, and geopolitical shocks. As institutional players allocate to BTC, the supply held by short-term speculators continues to decline.

Market Outlook: Macro Tailwinds Ahead

Nic Puckrin, founder of The Coin Bureau, noted that Bitcoin is defying sideways trends seen in gold, oil, and equities. “Markets are in wait-and-see mode, but Bitcoin is pressing forward,” he said. “The $100K level is being cemented as the base price in investor psychology.”

Puckrin pointed to future liquidity injections as a key bullish driver, including two expected U.S. rate cuts this year and Japan’s easing stance in 2026. When liquidity returns, Bitcoin could be a primary beneficiary.

Meanwhile, spot Bitcoin ETFs have attracted $2.4 billion in inflows over the past eight sessions, led by BlackRock’s IBIT and Fidelity’s FBTC — a strong indicator of sustained institutional demand.

At the time of writing, Bitcoin trades around $104,200, with $23.4 billion in 24-hour volume.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.