Bitcoin (BTC) is currently trading just above $108,800, maintaining a narrow range as investors await a decisive market catalyst. While the digital asset sits close to its multi-month high, the overall sentiment appears cautious, driven by declining volumes and shifting investor focus.

Institutional Inflows Slow Despite High MVRV Ratios

Recent on-chain data reveals that spot trading volumes for Bitcoin are notably below historical averages, suggesting a lack of retail momentum. Additionally, Exchange-Traded Fund (ETF) inflows have declined significantly from recent peaks, indicating that institutional participation is cooling off.

One key metric—Market Value to Realized Value (MVRV)—remains elevated, which typically signals high unrealized gains across investor holdings. However, rather than sparking bullish momentum, this condition appears to be discouraging further entries from large players, potentially due to concerns about profit-taking risk at these levels.

Market Rotation Favors Large Caps and Meme Coins

As Bitcoin consolidates, market attention has shifted toward large-cap altcoins and trending meme tokens, drawing liquidity away from mid-cap and emerging assets. Analysts have observed a rotation of capital, reflecting a flight to perceived safety and short-term speculation.

This behavior highlights a key theme: investors are positioning defensively, awaiting either macroeconomic clarity or a clear technical breakout from Bitcoin’s current range before deploying more capital into the broader market.

Low Conviction Keeps Bitcoin Rangebound

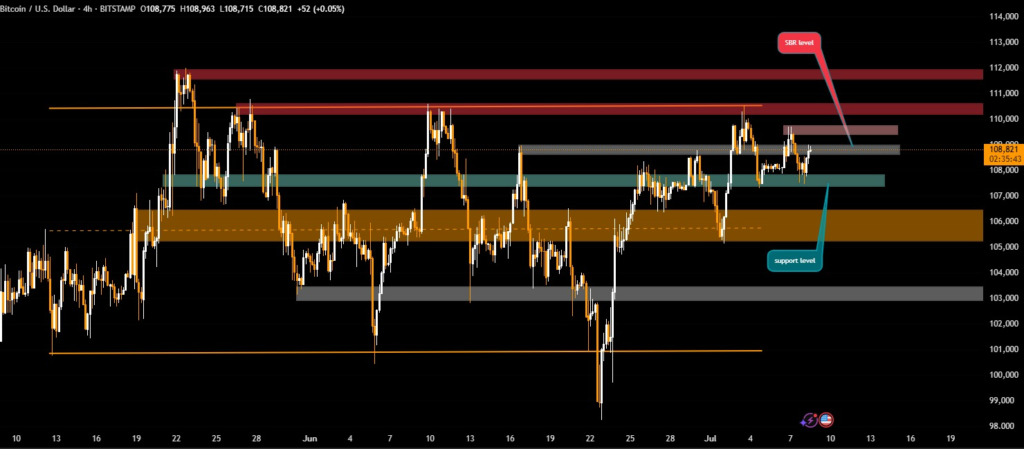

Despite being near the $109K mark, Bitcoin remains stuck in a holding pattern. The lack of significant news, regulatory clarity, or macro drivers has left traders without a strong directional bias. Until a catalyst emerges—be it a central bank decision, regulatory shift, or a major adoption headline—the market is unlikely to break decisively upward or downward.

What Traders Should Watch Next

Looking ahead, key indicators to monitor include:

- ETF net inflows or outflows

- Spot volume trends on major exchanges

- On-chain activity levels, especially wallet accumulation

- Volatility metrics, such as Bollinger Band width and ATR

These factors will play a critical role in determining the timing and strength of Bitcoin’s next major move.

Final Thoughts

Bitcoin’s current price action near $109K reflects uncertainty rather than weakness. While structural bullish factors remain intact, including long-term holder accumulation and rising adoption, low conviction in the short term continues to keep price action subdued. Traders and investors alike are watching closely for the next catalyst that could provide the spark for a sustained rally.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.