Conflicting analyst views emerge as Bitcoin closes the year lower despite prior all-time highs

Bitcoin’s price action in 2025 has sparked renewed debate over market cycles, with some industry leaders characterizing the year as a bear market despite record highs earlier in the year. The discussion highlights diverging interpretations of market structure, sentiment, and what may lie ahead for the world’s largest cryptocurrency.

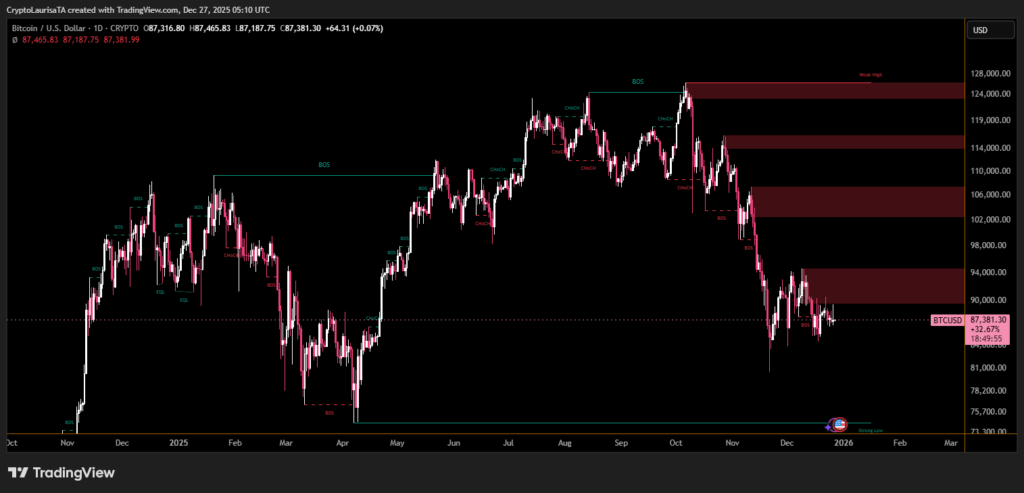

Bitcoin reached a new all-time high above $125,000 in October, yet it is now trading below its opening price for the year. As of late December, Bitcoin is down nearly 9% year-to-date, a rare outcome for an asset historically associated with strong post-halving performance.

Market sentiment has remained subdued, with fear indicators staying in “extreme fear” territory for much of December, reflecting investor caution rather than exuberance.

A contrasting view suggests that 2025 may represent a reset phase before a prolonged expansion. Proponents of this thesis believe Bitcoin could be entering a structural bull market extending well into the next decade, driven by scarcity dynamics, institutional adoption, and macroeconomic shifts.

Historically, Bitcoin has not posted two consecutive red yearly candles, adding weight to expectations of a recovery ahead.

Not all forecasts are optimistic. Some market veterans expect further downside in 2026, with projections ranging from $60,000 to $65,000, citing macro uncertainty and cyclical exhaustion. Others maintain that Bitcoin’s network fundamentals remain intact, positioning it for renewed growth once sentiment stabilizes.

Whether 2025 is remembered as a bear market or a transitional pause, the split outlook underscores Bitcoin’s evolving maturity. The coming year may determine whether the asset enters a prolonged growth phase or continues to consolidate before its next major move.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.