Strategy CEO says long-term indicators outweigh short-term volatility for Bitcoin investors

Bitcoin’s price may be under pressure heading into year-end, but core market fundamentals remain exceptionally strong, according to Strategy CEO Phong Le. Speaking amid declining sentiment and heightened volatility, Le emphasized that Bitcoin’s structural progress in 2025 has continued regardless of recent price action.

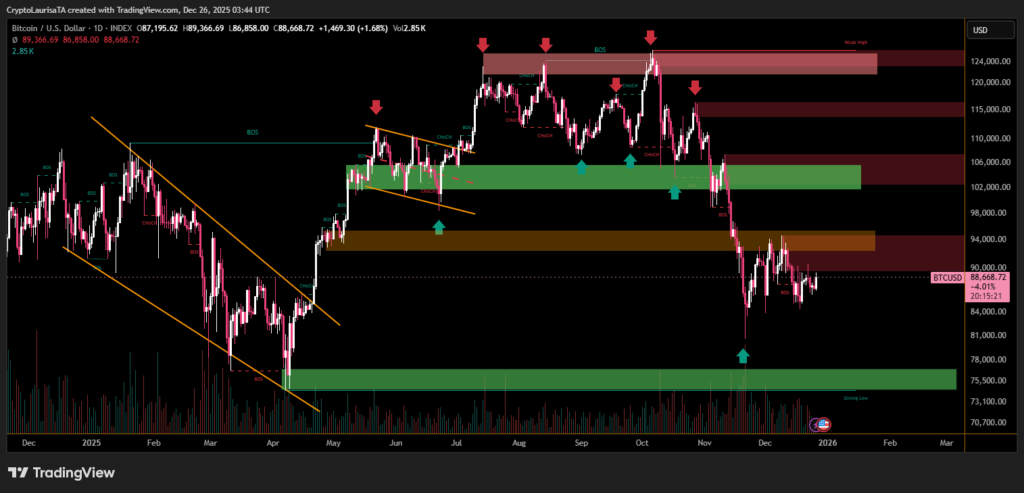

Bitcoin reached a record high of $125,100 in early October before retracing nearly 30%, now trading near the $88,000 level. At the same time, sentiment indicators have reflected extreme fear since mid-December. Despite this, Le argued that price fluctuations do not accurately reflect the asset’s long-term trajectory.

He noted that short-term movements are often driven by technical factors and liquidity cycles, making them difficult to interpret. For investors focused on shorter horizons, Le advised a methodical, data-driven approach, rather than emotional reactions to market swings.

Institutional and Government Momentum Builds

Le pointed to growing institutional engagement and policy support as key indicators of Bitcoin’s health. Traditional financial institutions, particularly banks in the US and Middle East, are actively exploring ways to integrate Bitcoin into their frameworks.

He also highlighted unprecedented support from US policymakers, including formal steps toward national digital asset infrastructure. While a fully defined strategic Bitcoin reserve has yet to be finalized, ongoing government actions signal deeper acceptance.

According to Le, the alignment of institutional adoption, regulatory clarity, and treasury participation makes the current period especially constructive for Bitcoin’s long-term outlook, even as short-term volatility persists.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.