Latest decline is modest compared with past drops, yet investor confidence has plunged to levels last seen in March

Bitcoin’s latest slide below the six-figure mark has triggered a sharp deterioration in market psychology, even though the scale of the decline remains smaller than previous drawdowns in the current cycle.

Fear Index Nears Extreme Territory

The crypto sentiment gauge widely tracked by traders — the Fear & Greed Index — has fallen to 22, marking one of its weakest readings since March and signaling elevated caution among market participants. Market analyst Nic Puckrin noted that “this dip is the smallest of the cycle… but it feels so much worse. Sentiment cooked.”

While Bitcoin has faced deeper retracements earlier in the year, the current mood reflects mounting uncertainty across digital assets. Over 70% of Polymarket traders now expect Bitcoin to fall below $90,000, coinciding with heavy selling from long-term holders. More than 400,000 BTC were reportedly off-loaded in October alone.

Investors Debate Whether a Bear Market Is Emerging

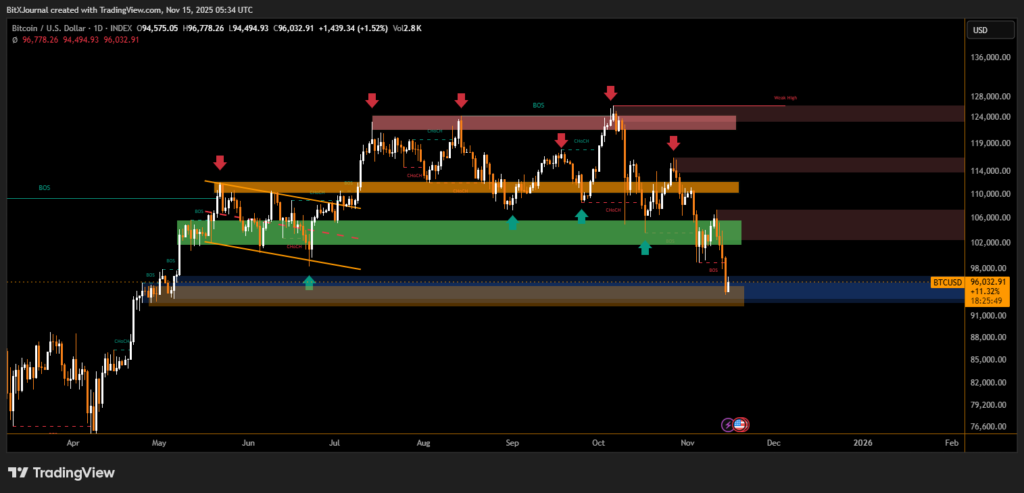

The debate now focuses on whether the latest downturn is the first stage of a broader reversal or simply a reset before fresh highs in 2026. Analysts argue that the path forward depends largely on interest-rate policy and global liquidity conditions.

Bitcoin has slipped decisively below its 365-day moving average, a level many traders consider a crucial indicator of long-term trend direction. Repeated breaks below this support have amplified fears of a deeper correction.

ETF Outflows Not the Main Driver, Analysts Say

Despite speculation that Bitcoin ETFs may be accelerating the sell-off, senior analyst Eric Balchunas pushed back, saying ETF holders “remained remarkably steady despite a 20% price shock.” Outflows totaled roughly $1 billion over the past month — far smaller than the broader market’s leveraged wipeout during October’s historic liquidation event.

Rotation Into Other Assets Pressures Outlook

Galaxy’s research head Alex Thorn trimmed his 2025 Bitcoin forecast from $180,000 to $120,000, citing shifts toward competing themes like gold and AI, as well as ongoing forced liquidations in derivatives markets.

Meanwhile, ARK Invest founder Cathie Wood warned that stablecoins are steadily eroding Bitcoin’s role as a preferred store of value in emerging markets, adding another layer of pressure to sentiment already in decline.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.