Bitcoin could remain under pressure relative to traditional equities as the current market cycle matures, according to recent analyst commentary. Expectations that capital will quickly rotate from gold and silver into Bitcoin may be premature, particularly as macroeconomic uncertainty continues to favor defensive assets.

Gold and silver have recently surged to record highs, with gold trading above $5,600 per ounce and silver exceeding $120. Some investors interpret these moves as a leading signal for a future Bitcoin rally. However, market analysts caution that historical correlations do not guarantee a near-term shift into crypto.

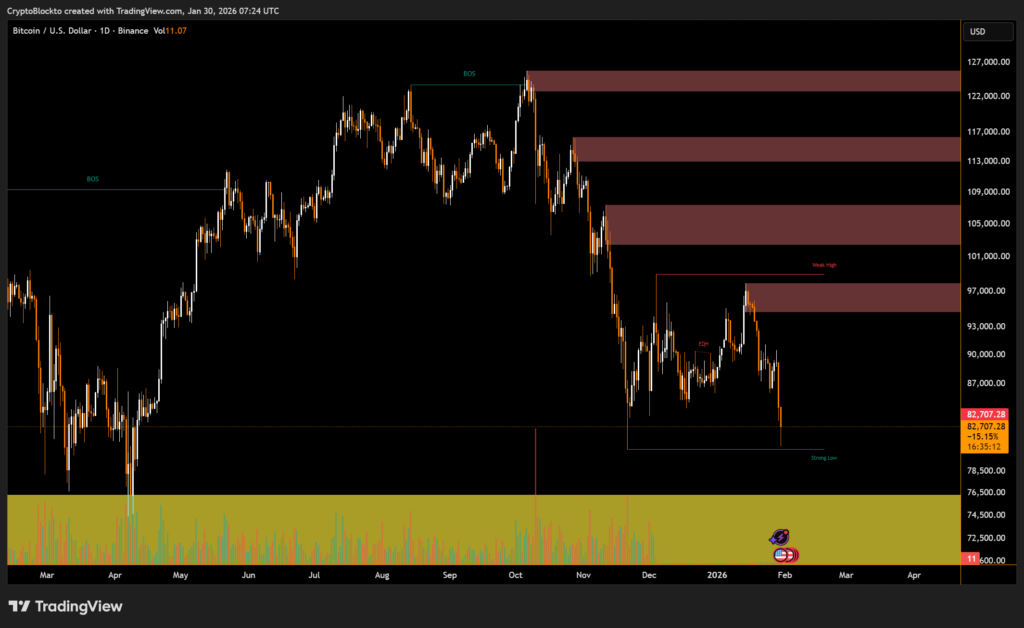

Bitcoin Shows Weak Relative Performance

Bitcoin has declined roughly 6% over the past month and is down nearly 8% over the last seven days, trading around $82,800. Relative to the stock market, Bitcoin continues to lose ground, reflecting waning risk appetite across digital assets. Broader sentiment indicators remain subdued, with investor confidence showing signs of extreme caution.

Diverging Views on Market Timing

While short-term expectations remain cautious, not all analysts share the same outlook. Some market observers argue that Bitcoin historically lags gold during periods of macroeconomic stress, with recoveries often occurring months after precious metals peak in relative strength.

Based on prior cycles, these analysts suggest a potential inflection point could emerge later in the first quarter of 2026, assuming risk appetite begins to return to global markets.

Gold typically leads during periods of heightened economic uncertainty, while Bitcoin tends to benefit once investors reengage with higher-risk assets. Whether this pattern holds remains uncertain, but for now, Bitcoin appears vulnerable to continued underperformance against both equities and safe-haven assets as the cycle winds down.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.