HIVE Digital Technologies saw its stock rise on Monday after the company released financial results showing the strongest quarterly revenue in its history — a boost largely driven by higher Bitcoin prices and a major expansion of its mining capacity.

The firm reported $87.3 million in revenue for the quarter ending Sept. 30, marking a 285% increase compared to the same period last year and nearly double the previous quarter’s results. Despite the revenue surge, HIVE still recorded a net loss of $15.8 million, which it linked to the accelerated two-year depreciation schedule for the new Bitcoin mining equipment it deployed during its expansion in Paraguay.

Executive chairman Frank Holmes highlighted that even though Bitcoin hashprice rose only about 25% year-over-year, HIVE’s aggressive growth in mining power allowed revenues to multiply far more quickly.

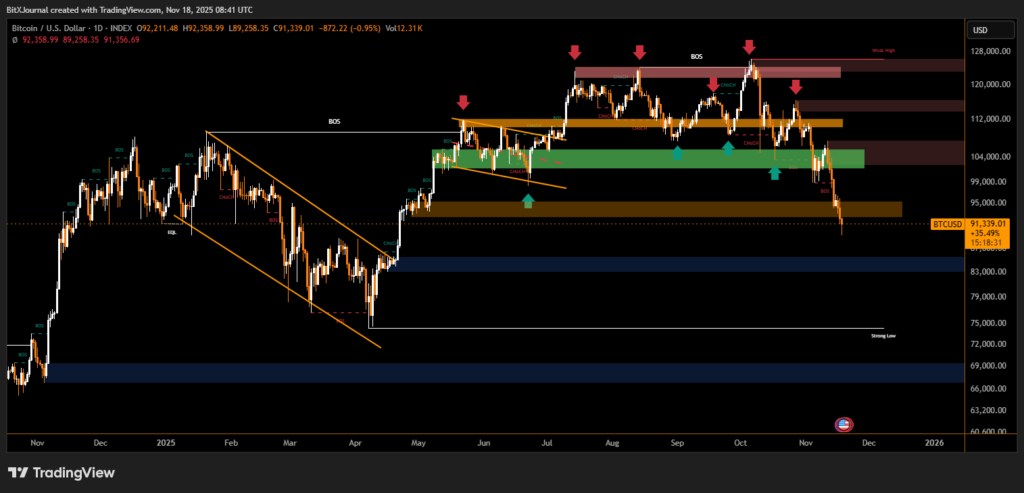

The gains came during a strong period for Bitcoin itself. Over the third quarter, BTC climbed from around $107,000 in early July to above $123,500 by mid-August, eventually hitting a new peak of over $126,000 in early October. Since then, the price has retraced sharply, slipping nearly 28% and briefly falling below $90,000 on Tuesday.

Stock reaction

HIVE’s stock responded immediately to the earnings release, ending Monday up 7.55%, with a further 0.56% increase after hours to reach $3.58.

Even with the latest uptick, the stock remains well below its 2025 high of $6.96 recorded in early October. The decline mirrors the broader pullback across crypto-related equities as investors rotate out of higher-risk positions during Bitcoin’s downturn. Still, the company is up 25% year-to-date.

Mining performance and industry trends

HIVE generated $82.1 million from Bitcoin mining alone — double the figure from a year earlier — and mined 717 BTC during the quarter despite rising network difficulty.

Other major miners have posted similar revenue surges for the September quarter.

- Bitdeer reported a 174% year-over-year increase to $169.7 million.

- TeraWulf announced revenues of $50.6 million, up 87% from last year.

A growing share of miners are also turning toward artificial intelligence computing, seeking to diversify amid rising competition and costly operations in crypto mining. HIVE’s own AI-focused division recorded $5.2 million in revenue — its best quarter yet and a 175% jump from last year.

Reflecting this trend, Bitfarms revealed last week that it intends to wind down its mining operations over the next two years and shift fully into AI infrastructure, with CEO Ben Gagnon saying this path offers a better long-term outlook for most U.S.-based mining firms.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.