Bitcoin miner outflows spiked sharply in early February, with nearly 49,000 BTC moving from miner-linked wallets over two days. On Feb. 5 alone, 28,605 BTC—worth approximately $1.8 billion—were transferred, followed by another 20,169 BTC valued at around $1.4 billion on Feb. 6, according to on-chain data . The last comparable surge occurred in November 2024.

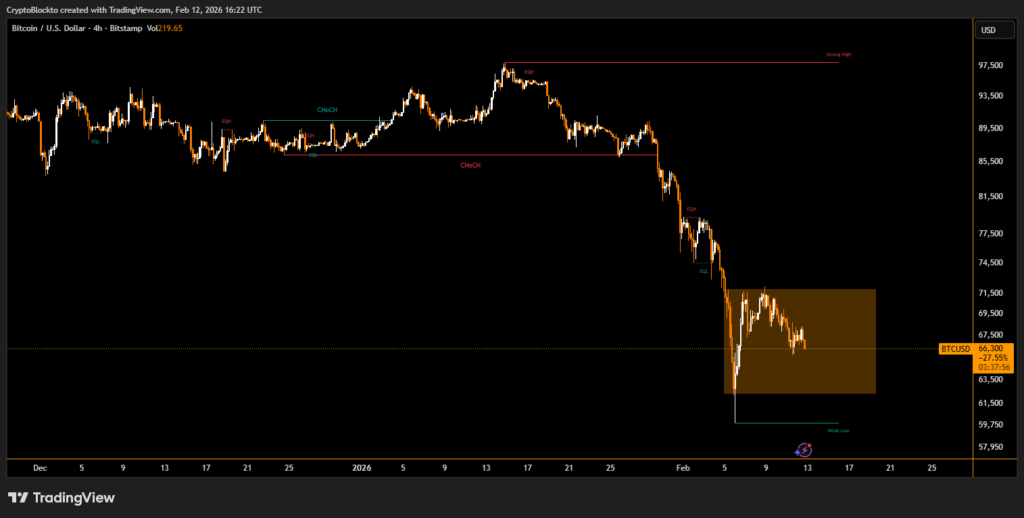

The transfers coincided with heightened volatility. Bitcoin traded near $62,809 on Feb. 5 before rebounding to $70,544 a day later. Large miner outflows during sharp price swings often raise concerns about potential selling pressure, though wallet movements do not necessarily indicate immediate spot-market sales.

Public Miner Sales Remain Limited

Eight publicly reporting miners — including CleanSpark, Bitdeer, Hive Digital Technologies, BitFuFu, Canaan, LM Funding America, Cango and DMG Blockchain Solutions — produced a combined 2,377 BTC in January. That figure is significantly lower than the 28,605 BTC transferred in a single day.

CleanSpark mined 573 BTC and sold 158.63 BTC, ending January with 13,513 BTC in reserves. Cango mined 496.35 BTC and sold 550.03 BTC, later offloading an additional 4,451 BTC for roughly $305 million to repay debt and fund expansion into artificial intelligence infrastructure. Other miners, including Canaan and LM Funding, reported reserve increases with minimal or no sales.

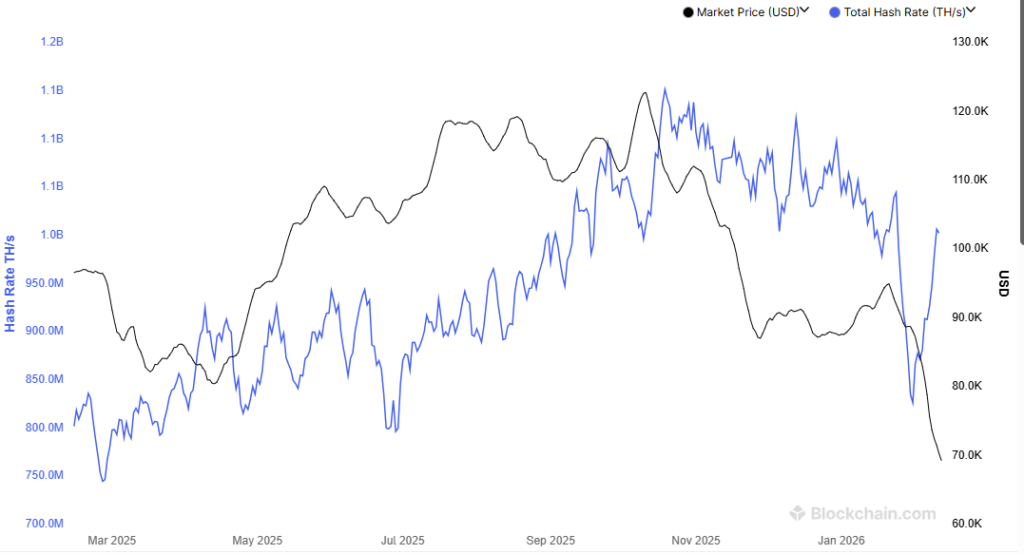

Network Hashrate Drops Amid Winter Storms

Bitcoin’s hashrate also fluctuated in late January, falling to 663 exahashes per second — a drop of over 40% — as severe winter storms in the United States forced temporary curtailment of operations. Hashrate levels recovered in early February as conditions stabilized.

While miner outflows surged, public disclosures suggest no broad capitulation across the sector.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.