Bitcoin’s recent price action has caught the attention of traders and analysts as it recorded a significant 20% gain following the appearance of a bullish on-chain signal known as the “Hash Ribbon ‘buy’ signal.” Adding to this positive sentiment, Bitcoin miners — often seen as key market participants — have stopped selling their coins, a behavior historically associated with strong bullish trends.

What is the Hash Ribbon ‘Buy’ Signal?

The Hash Ribbon is a technical indicator that leverages Bitcoin’s mining hash rate to detect periods of miner capitulation and recovery.

When the 30-day average crosses above the 60-day average after a period of decline, it flashes a “buy” signal. This crossover indicates that miners are returning to the network, signaling renewed confidence and operational stability in the mining ecosystem.

Historically, this signal has preceded some of Bitcoin’s most notable rallies — suggesting that current market conditions could be lining up for further gains.

BTC Gains 20% Since Latest Signal

The latest Hash Ribbon ‘buy’ signal appeared just weeks ago, and Bitcoin has already climbed roughly 20% since then. The cryptocurrency surged from around $86,000 to over $103,000, with strong momentum in both spot and derivatives markets.

This upward move reinforces the Hash Ribbon’s reputation as one of the most reliable on-chain buy indicators. Traders and long-term holders alike often use it to validate their bullish thesis — particularly when other market factors align, as they seem to be doing now.

Miners Pause Selling: A Bullish Confirmation

One of the most telling developments during this rally is the behavior of Bitcoin miners. On-chain data reveals that miners have significantly reduced or completely halted the sale of their Bitcoin holdings since the signal appeared.

This change in behavior is significant for a few reasons:

- Reduced Selling Pressure: When miners sell their rewards, they add downward pressure on the price. The lack of sales means more supply is being held rather than dumped on the market.

- Confidence in Higher Prices: Miners are considered some of the most informed market participants. Their decision to hold indicates they may be expecting higher prices in the near future.

- Operational Recovery: Pausing sales could also mean miners have improved cash flow or access to capital and are no longer forced to liquidate to cover expenses.

Bitcoin Holds Firm Above $100K

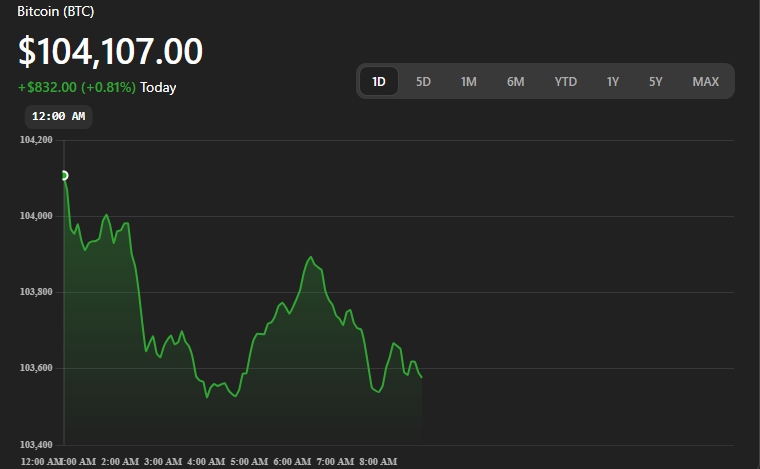

As of May 14, 2025, Bitcoin is trading at approximately $103,591, with an intraday high of $104,836 and a low of $102,722. The psychological $100,000 level has acted as a solid support zone during recent volatility.

This consolidation above $100K could indicate a new floor, especially if institutional demand for spot Bitcoin ETFs and long-term holders continue to grow.

Looking Ahead: Bull Market Momentum Building?

The combination of bullish on-chain signals, miner accumulation, and strong price action points to growing momentum in the Bitcoin market. While no indicator is perfect, the Hash Ribbon signal has historically aligned with longer-term uptrends.

Traders and investors should watch for sustained miner behavior, macroeconomic cues, and ETF flows to gauge whether this rally has more room to run.

Conclusion

Bitcoin’s 20% price rally following the Hash Ribbon ‘buy’ signal, combined with miners halting sales, paints a compelling bullish picture. While short-term corrections are always possible, the overall setup suggests growing confidence and the potential for further upside in the weeks ahead.