In a stunning milestone for the cryptocurrency world, Bitcoin’s market capitalization has soared to over $2.20 trillion, placing it ahead of several major national currencies. This landmark moment marks a significant shift in global financial power as digital assets continue to challenge traditional fiat currencies.

Bitcoin Beats the Taiwan Dollar and Others

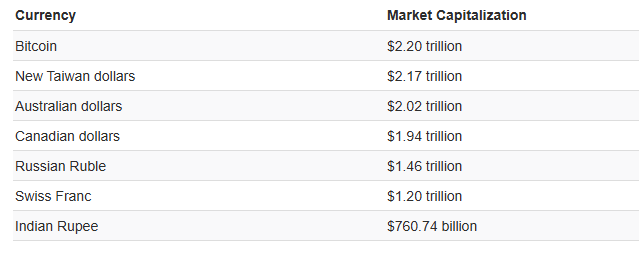

According to recent market data, Bitcoin’s total value now surpasses that of the New Taiwan Dollar (TWD), the Australian Dollar (AUD), and even the Russian Ruble (RUB). Here’s a comparison:

“Bitcoin is no longer just a digital asset; it’s a macroeconomic force,” said a leading crypto analyst.

The rise in BTC’s valuation highlights growing global confidence in decentralized finance and a weakening trust in inflation-prone fiat currencies.

Why Bitcoin’s Market Cap Matters

Bitcoin’s growing market cap is not just a number—it has deep implications for investors, governments, and the global economy. With a cap greater than the GDPs or M2 money supplies of several countries, Bitcoin is increasingly viewed as “digital gold” or a safe haven against fiat currency devaluation.

Its limited supply of 21 million coins stands in stark contrast to the endless money printing by central banks.

This rise also means Bitcoin has more liquidity and economic influence than ever before, attracting institutional investors and hedge funds alike.

What This Means for Global Finance

- Bitcoin’s dominance signals a shift in how people perceive and store value

- More countries may consider crypto integration or regulation

- It raises questions about the future role of central banks in a decentralized economy

With Bitcoin now outpacing entire national currencies, traditional financial systems are being forced to adapt—or risk becoming obsolete.

The Digital Currency Revolution Is Real

From the New Taiwan Dollar to the Russian Ruble, Bitcoin has overtaken currencies once thought untouchable.

This isn’t just a milestone—it’s a moment of reckoning for the global monetary system.

As Bitcoin continues to gain ground, the debate is no longer about if crypto will go mainstream—but how soon.