Steep Futures Unwinding May Signal a Reset Before a Potential Bullish Reversal

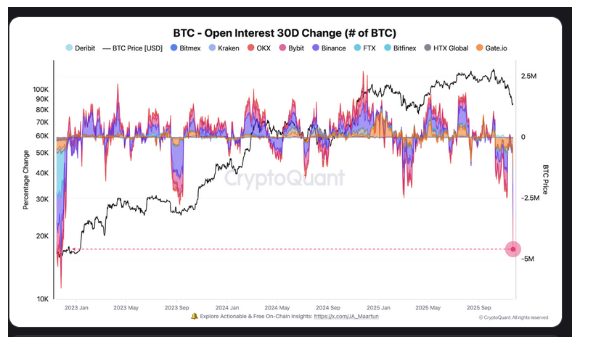

Bitcoin’s derivatives market has undergone a significant reset over the past month, with open interest sliding sharply as the cryptocurrency works through its latest correction. Analysts now suggest that the steep decline in leveraged positioning may be setting the stage for a more sustainable recovery.

Data tracked over the past 30 days shows the largest drop in Bitcoin open interest of the current cycle, with levels falling by roughly 1.3 million BTC. At current prices near the $87,500 range, the notional value of that reduction is estimated at over $110 billion. The rapid unwind coincides with Bitcoin’s 20% decline since mid-October and its more than 30% pullback from the record highs above $126,000 reached earlier this fall.

According to one on-chain analyst, the ongoing contraction is closely tied to the wave of liquidations that has swept through the market. “The cascading price action pushed many traders to reevaluate or close positions, while others have stepped back entirely to reduce risk exposure,” the analyst explained. He added that phases of aggressive deleveraging often help form durable market bottoms, allowing speculative excess to reset.

“Historically, these cleanup periods remove overconfidence, rebalance leverage, and create healthier conditions for the next move,” he said, noting that the last comparable episode occurred during the deep retracement in 2022. The magnitude of the current unwind highlights how significant this cleansing period has become.

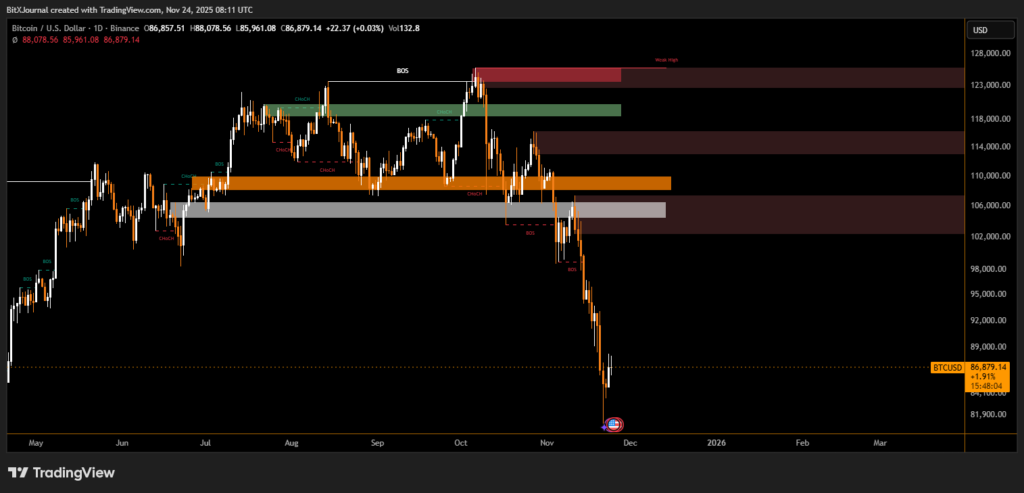

Critical Price Levels Could Define Bitcoin’s Next Move

Market strategists believe the days ahead will play an important role in determining whether momentum shifts back in favor of buyers. One prominent analyst noted that the next bullish impulse could emerge if Bitcoin regains stability above the $90,000 to $96,000 range.

“Fear and panic have dominated the past several sessions, but those moments often present the strongest opportunities,” he said, adding that a decisive move higher could revive the prospect of a retest of all-time highs.

With leverage now flushed from the system and spot demand gradually resurfacing, many traders are watching closely for signs that Bitcoin’s bottoming process may be nearing completion, potentially paving the way for a renewed trend.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.