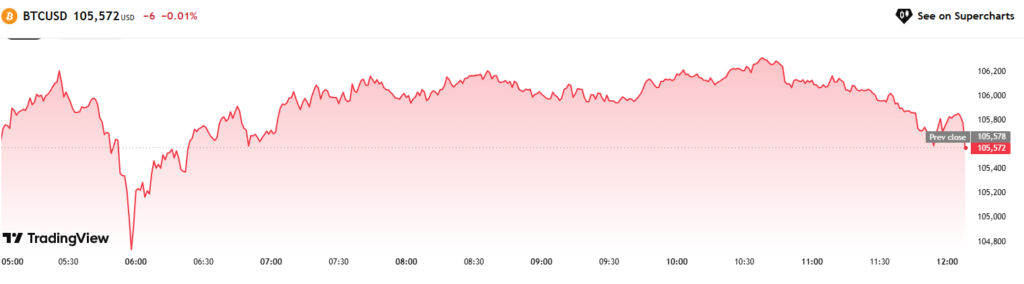

Bitcoin (BTC) is undergoing a “healthy pause” near $106,000, giving the crypto market time to digest recent gains after reaching an all-time high above $111,000 last week. Experts believe this consolidation phase could set the stage for a stronger bullish trend in the coming months.

Bitcoin Consolidates After ATH Surge

According to Nick Forster, founder of the on-chain options protocol Derive, the current sideways movement is a natural correction after Bitcoin’s recent rally.

“While the recent surge to over $111,000 was notable, the current price action suggests a phase of consolidation rather than an imminent breakout,”

“This pause will give the market time to digest recent gains and gear up for the next phase.”

At the time of writing, Bitcoin is trading at $105,712, up 11.59% over the past 30 days,

Bullish Outlook for 2025: $220K–$330K Targets

While Bitcoin cools down, analysts are already eyeing major upside potential. Researcher Sminston With projected a 100% to 200% gain from current levels, forecasting a cycle peak between $220,000 and $330,000.

Trader Apsk32 offered a more conservative view, expecting Bitcoin to reach $220,000 by 2025.

Macroeconomic Factors in Focus

The recent U.S. Court of International Trade ruling against Trump’s broad tariff regime briefly eased fears of trade-induced inflation. However, the Court of Appeals decision on May 29 to temporarily allow the tariffs keeps market uncertainty in play.

Forster noted that the Federal Reserve’s upcoming interest rate decision on June 18 will be “pivotal” for short-term price action.

Q3 Could Defy Historical Trends

Historically, Q3 has been Bitcoin’s weakest quarter, with an average return of 6.03% since 2013, per CoinGlass. However, Forster expects 2025 to break the pattern, citing regulatory tailwinds and growing institutional adoption.

“The potential for favorable regulatory developments and continued institutional interest may support stronger performance in Q3,” he said.

Bitcoin ETF Inflows Yet to Boost Price

Despite a surge in spot ETF inflows — over $6.2 billion into BlackRock’s IBIT alone in May — Bitcoin’s spot price has not yet reflected this demand.

“This can be attributed to institutional ETF investments not immediately impacting spot markets,” .

In the week ending May 23, spot Bitcoin ETFs saw $2.75 billion in inflows, highlighting growing institutional confidence.