Nasdaq weakness, AI-sector volatility, and Broadcom’s sharp decline pressure Bitcoin toward major demand zones

Bitcoin fell decisively below the 90,000 USD level as turbulence across technology stocks spilled into the digital asset market. Concerns surrounding the AI sector and a steep sell off in major chipmakers most notably Broadcom which dropped nearly 10 percent intensified risk aversion. Additional signals from Federal Reserve officials regarding deeper potential cuts in 2026 contributed to uncertainty, dragging sentiment further.

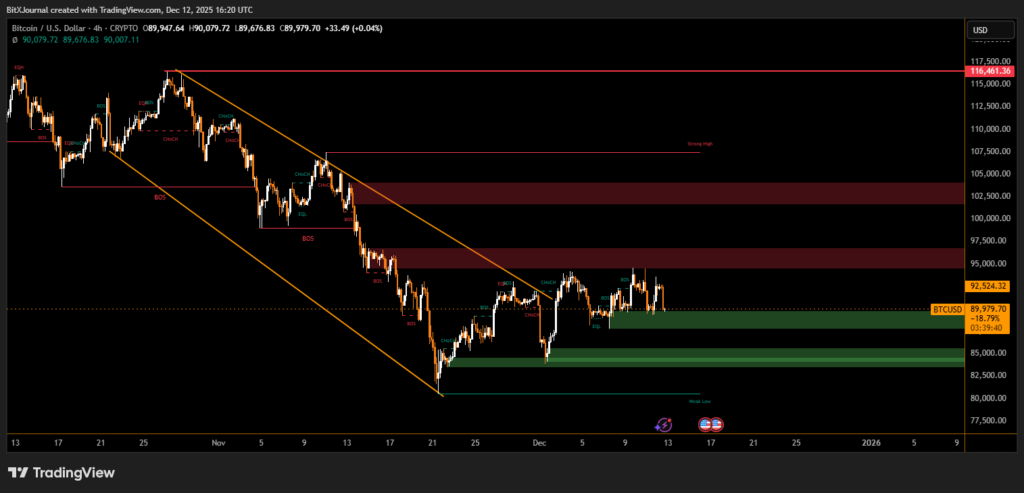

Current price structure shows Bitcoin testing the lower boundary of a critical 4-hour demand zone, an area that has previously triggered strong counter rallies. The sharp decline follows multiple Break of Structure (BOS) events on lower timeframes, confirming a sustained bearish trend throughout recent sessions. The chart also highlights several equal low formations, which suggest liquidity pools that may attract further downside before any attempt at recovery.

Overhead, BTC faces layered resistance near 92,500 USD, followed by broader supply zones around 97,000–102,000 USD. These regions remain significant caps on upward momentum and align with prior breakdown levels that fueled the current sell-off. Unless Bitcoin can reclaim these areas with convincing volume, bullish continuation will remain limited.

Market sentiment deteriorated further after comments from Chicago Feds Austan Goolsbee who hinted at more rate cuts for 2026 than the current median outlook, injecting additional uncertainty into the macro narrative. With AI-related stocks experiencing renewed volatility, the risk-off tone across equities translated directly into crypto outflows.

Bitcoin’s move below 90,000 USD reflects a convergence of technical weakness and macro pressure. While price is approaching deeper demand zones, market recovery will depend on stabilization in tech equities and a shift in broader risk appetite.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.