Bitcoin holds firm near key support, setting stage for potential bullish reversal

Bitcoin (BTC) has shown renewed strength this week, climbing above the critical $104,000 level after a period of sharp volatility. The world’s leading cryptocurrency is now testing an important technical zone that could determine whether it regains upward momentum heading into mid-November.

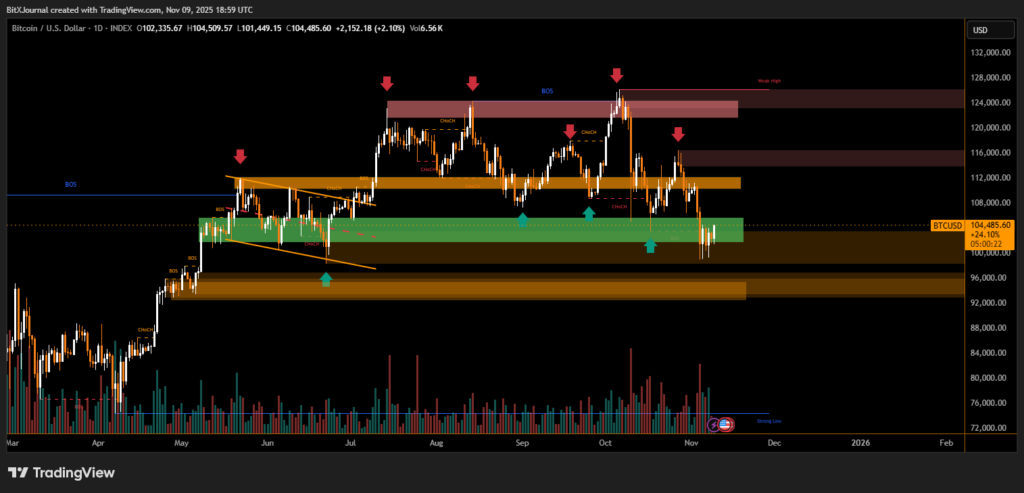

According to the latest market structure, BTC has found strong demand within the $100,000–$102,000 support range, where buyers stepped in to defend price from deeper losses. A clear Break of Structure (BOS) is visible on the daily chart, hinting that bearish pressure may be easing after weeks of heavy selling.

“Bitcoin is showing early signs of stabilization,” said BitXJournal market analyst. “If it holds above $104K and manages a daily close beyond $106,000, it could mark the beginning of a short-term bullish reversal.”

Key resistance at $106K could define next trend

The $106K resistance zone represents a crucial inflection point for Bitcoin’s price action. A breakout above this level could open the door toward $112K and $118K, both areas highlighted by prior liquidity clusters and sell-side imbalances.

On the other hand, failure to sustain above $104K could see the market revisit the green demand zone between $98K and $100K, where previous accumulation occurred. Volume analysis suggests buyers are slowly regaining control, though momentum remains fragile amid cautious investor sentiment.

Analysts note that the ongoing Change of Character (CHoCH) and rising volume at current levels are encouraging signs. The price structure still sits within a broader consolidation phase, but traders are watching for confirmation of trend strength above the $106K breakout mark.

As BitXJournal trader summarized, “Bitcoin’s structure is shifting. Holding above $104K is critical; a decisive move past $106K could reignite the bullish cycle.”

With macro uncertainty fading and liquidity returning to the market, Bitcoin’s defense of key support zones may set the tone for a potential recovery rally in the weeks ahead.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.