Bitcoin (BTC/USD) has climbed back above the $109,000 mark, showing signs of strength despite lingering macroeconomic concerns and ETF outflows. This movement hints at renewed buying interest and improving market sentiment.

BTC/USD Price Update: Bulls Reclaim Key Level

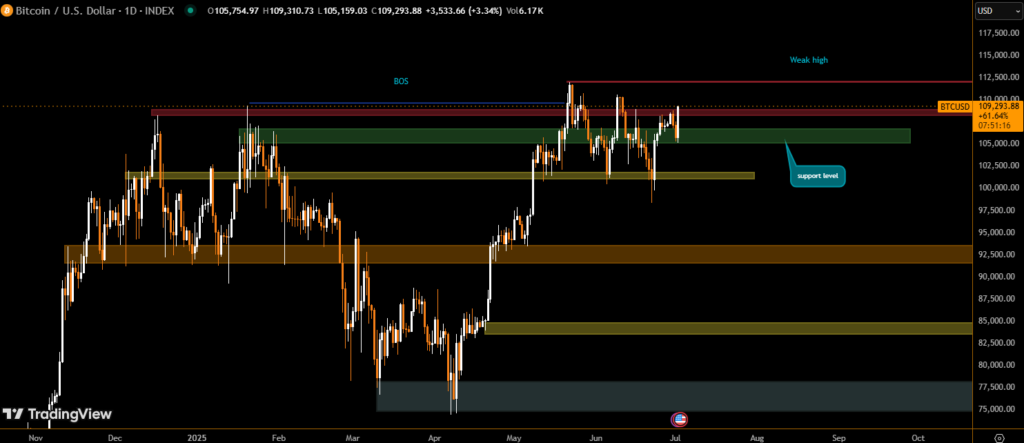

As of July 2, 2025, Bitcoin is trading at approximately $109,300, recovering strongly from recent lows near $105,000. The rebound follows a temporary dip to fill the CME futures gap and now positions BTC at the upper boundary of a descending channel that has persisted since late May.

The breakout above $109K signals a potential shift in momentum, challenging the short-term bearish structure.

Since its high of $112,000 on May 22, Bitcoin has faced a series of lower highs and lower lows. However, the shallower nature of recent pullbacks suggests bullish undercurrents.

Short-Term Holder Strength and Realized Price Support

According to on-chain data, Bitcoin remains above its 1-month realized price, currently around $105,600, indicating that short-term holders are still in profit. This adds strength to the ongoing uptrend, as profit-taking pressure appears limited.

BTC’s support between $105,000–$106,000 remains crucial, having absorbed selling during macro-driven corrections.

ETF Flows and Institutional Sentiment

On July 1, U.S. spot Bitcoin ETFs experienced a $342 million net outflow, ending a 15-day inflow streak. Despite this, Bitcoin’s ability to hold and rebound above $109K shows that broader market confidence remains intact.

While institutional flows have paused, analysts suggest this is not yet a trend reversal. Instead, consolidation between $105,000 and $110,000 could act as a bullish base—especially if new catalysts emerge.

Bitcoin Price Outlook: Eyes on $112K and Macro Data

The next resistance lies near $110,800–$112,000, with a confirmed breakout potentially triggering a move toward $118,000. On the downside, support zones to watch are $107,000 and $105,000.

Upcoming U.S. jobless claims data (July 3) and macroeconomic signals may drive short-term volatility. Until then, Bitcoin’s rebound above $109K signals healthy consolidation and potential for upside continuation.

BTC/USD trading above $109K reflects improving sentiment, short-term accumulation, and resilience in the face of ETF and macro pressures.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.