Market Pullback Deepens Despite Early Optimism in U.S. Equities

Bitcoin’s brief Nvidia-fueled lift has unraveled sharply, with the benchmark cryptocurrency sliding to $86,000 after failing to hold above key structural levels. The decline comes as U.S. equities also surrender early-session strength, leaving the Nasdaq up just 0.3% after a strong opening surge.

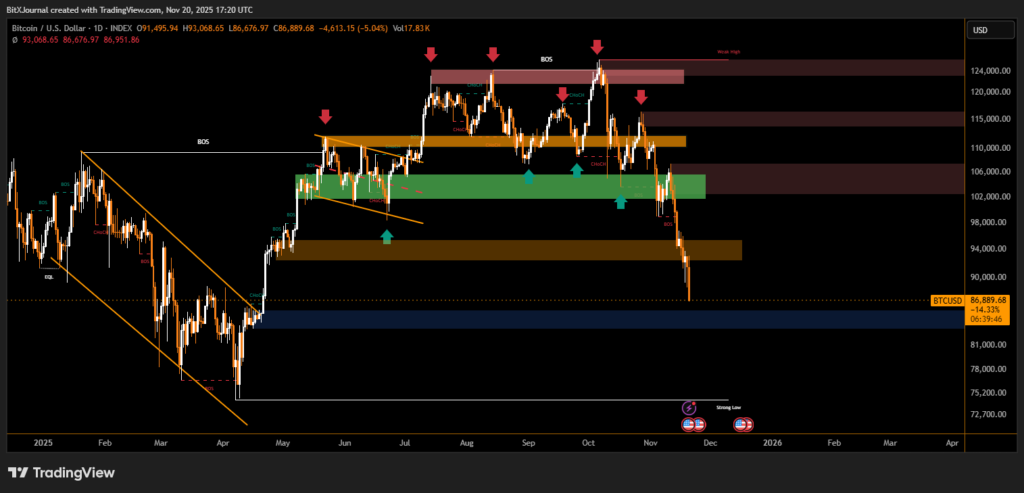

After showing signs of bullish momentum earlier in the month, Bitcoin has entered a pronounced pullback phase. The latest chart data highlights repeated rejections at major supply zones, followed by a decisive break in structure. With price action accelerating downward, traders are now focused on historically reactive demand regions that could determine the next directional push.

Technical Breakdown and Key Zones

The chart reveals a series of lower highs marked by successive rejections across the $115,000–$124,000 range—an area that has repeatedly acted as a heavy supply ceiling. Each upswing into this band triggered aggressive selling, signaling strong distribution pressure.

The break below the mid-range support near $98,000 marked the critical shift, triggering a clean downside sweep toward the $86,000 region.

BitXJournal market technician commented,

“Bitcoin’s inability to maintain structure above the $100K handle opened the door for deeper retracement. The current move is consistent with a market hunting liquidity before attempting a broader reset.”

Highlighted on the chart is a thick demand zone around $82,000–$86,000, where multiple bullish reactions have formed in previous cycles. This region now represents the most important short-term area to watch.

BitXJournal analyst observing the move added,

“If Bitcoin stabilizes in this lower block, we could see an interim bounce. But losing this level exposes liquidity pockets that extend toward the mid-$70,000 range.”

Macro Backdrop Adds Pressure

The broader risk environment offers little relief. While tech stocks initially surged on Nvidia’s earnings momentum, the enthusiasm faded quickly.

The Nasdaq giving back nearly its entire early advance underscores fragile sentiment across risk assets.

This synchronized pullback has intensified downward pressure on Bitcoin, which often trades in tandem with high-beta tech names during periods of market stress.

For now, traders are monitoring:

- $86,000 support as the immediate line keeping BTC from deeper losses

- $98,000 resistance as the first marker of structural recovery

- $115,000–$124,000 supply as the broader ceiling constraining upside

Until Bitcoin reclaims broken structure, the market remains vulnerable to further volatility. The coming sessions may determine whether the current drop becomes a temporary correction—or the start of a more significant trend shift.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.