BTC tests new highs as key resistance level comes under pressure

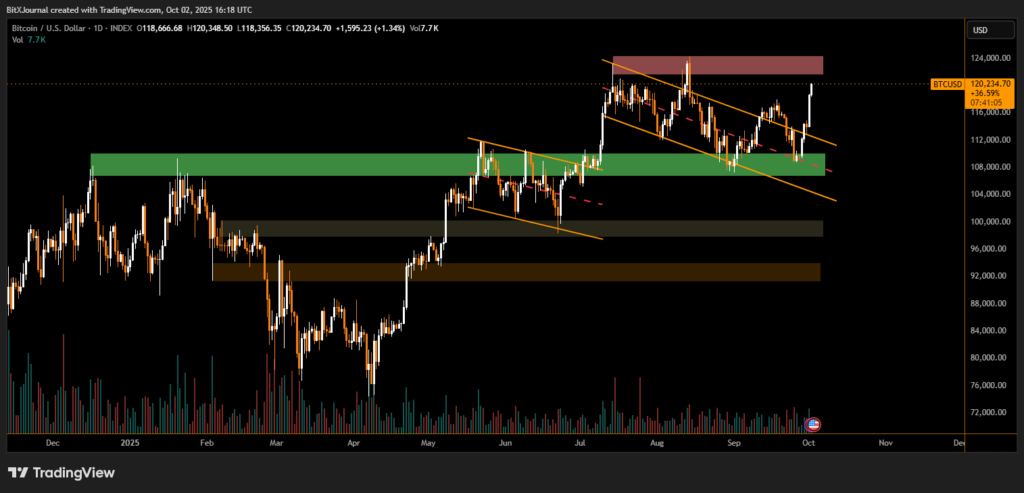

Bitcoin (BTC) has surged past the highly anticipated $120,000 level, breaking through a zone that previously acted as a rejection barrier. This move follows weeks of sideways consolidation within a descending channel and renewed strength after defending the $108,000–$110,000 support region.

The breakout is supported by a sharp increase in trading volume, signaling fresh demand from institutional and retail investors alike. Historically, levels around $120K have triggered profit-taking and short-term volatility, but the strong momentum this time suggests bulls may be preparing for higher targets.

“Bitcoin’s decisive push above $120,000 is technically significant. If the breakout holds on higher timeframes, the next upside targets are $123,500 and $128,000,”One of BITX market analyst observed. “However, failure to sustain above $120K could bring the price back toward the $116K–$114K consolidation zone.”

Technical point to strength

- Immediate resistance: $123,500

- Major resistance: $128,000

- Support levels: $118,000 and $114,000

The chart shows Bitcoin breaking out of a falling channel, with the $108,000 demand zone serving as a launchpad for the rally. The strong recovery suggests renewed bullish conviction, especially as BTC continues to outperform altcoins in recent sessions.

BITX Market strategists highlight that the weekly close above $120,000 will be critical. A sustained breakout could shift sentiment further in favor of long-term accumulation, while any rejection at this level might trap late buyers.

Traders remain cautiously optimistic. “We are entering a new phase of Bitcoin’s cycle where higher ranges are being tested. As long as BTC holds $118K on pullbacks, bulls remain in control,” another expert explained.

For now, the focus is firmly on whether Bitcoin can maintain its hold above $120,000, a move that could redefine near-term market structure and open the path toward new all-time highs.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.