Bitcoin (BTC) could be headed toward a 30% price rally, potentially breaching $140,000, according to a bullish chart pattern forming on BlackRock’s spot Bitcoin ETF (IBIT), which closely tracks the asset’s spot price. The analysis, conducted by CoinDesk’s Chartered Market Technician Omkar Godbole, points to a classic bull flag breakout, signaling that Bitcoin’s five-week consolidation phase may be over.

IBIT Chart Confirms Breakout Pattern

On Wednesday, IBIT surged 2.85%, briefly topping its May peak of $63.70, per TradingView data. This move reconfirms the bull flag breakout that initially emerged earlier this month — a pattern that typically precedes substantial upside continuation.

“Flags are continuation patterns, and their breakouts suggest the prior trend will resume,” said Godbole.

The IBIT breakout follows a strong rally from April’s lows, indicating the resumption of bullish momentum after a consolidation period. Using the measured move method, analysts forecast a potential 30% increase from the breakout point — which translates to Bitcoin hitting $140,000 or more.

Bitcoin Price Action Supports Bullish Outlook

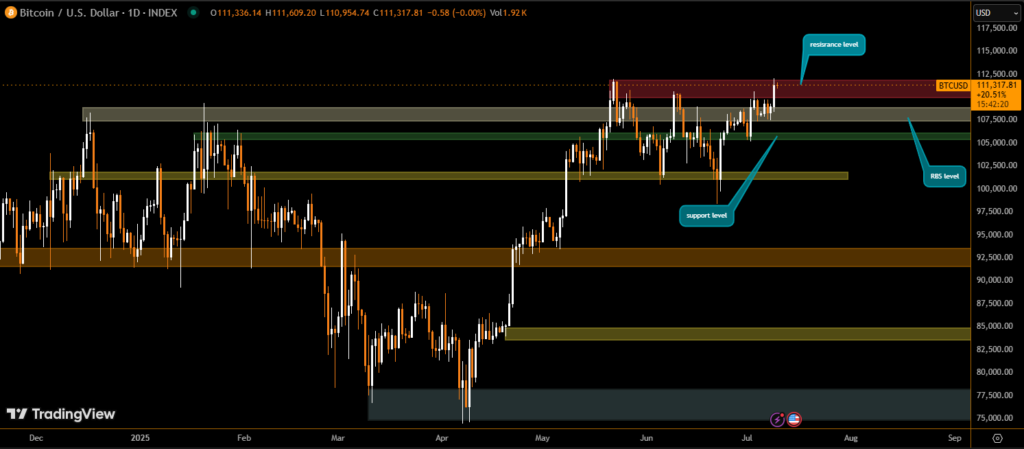

Bitcoin itself has been pushing higher, with its spot price recently breaching $111,000 — inching closer to its previous all-time high. Veteran trader Peter Brandt has also weighed in, noting a bullish setup on BTC’s chart that could see prices heading to $134,000 in the coming weeks.

While technicals are flashing green, macro risks remain the key wildcard. Any significant shifts in interest rate expectations, geopolitical tensions, or U.S. regulatory decisions could invalidate the bullish scenario.

Why It Matters

The emergence of a bull flag on a regulated, institutionally backed product like IBIT may serve as a stronger confirmation signal than similar patterns on BTC alone. With traditional investors increasingly using ETFs like IBIT to gain exposure to crypto, its technical outlook often mirrors — or even leads — price action in the spot market.

What’s Next for BTC?

If Bitcoin successfully clears $112,000 with conviction, analysts suggest the path toward $134,000–$140,000 could be swift, driven by momentum traders and institutional inflows.

Traders are watching for volume confirmation on both IBIT and BTC, as well as any emerging macroeconomic developments that could either accelerate or derail the bullish thesis.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.